Introduction: A New Era for Nigerian Corporate Taxation

The Nigeria Tax Act 2025, signed into law on 26 June 2025, represents the most ambitious tax reform in Nigerian history. For large businesses operating in Africa's largest economy, understanding these changes is not optional. The Act consolidates the Companies Income Tax Act, Personal Income Tax Act, Capital Gains Tax Act, Stamp Duties Act, and multiple levy frameworks into a single unified statute.

This is not merely administrative tidying. The substantive changes affect how multinational enterprises structure their Nigerian operations, how interest expenses are deducted, how transfer pricing is documented, and ultimately, how much tax you will pay. Companies that fail to adapt their tax planning to the new regime risk both unexpected liabilities and missed optimization opportunities.

Key Takeaways

- Large company threshold: Companies with turnover exceeding ₦100 million face 30% CIT rate

- New development levy: 4% of assessable profits replaces multiple sector-specific levies

- Transfer pricing tightened: Interest deductibility capped at 30% of EBITDA for related party loans

- Minimum tax: Multinationals with global revenue exceeding EUR 750 million face 15% minimum ETR

- Small company relief: Businesses with turnover of ₦50 million or less now exempt from CIT entirely

- VAT unchanged: Remains at 7.5% but with expanded input recovery on services and capital assets

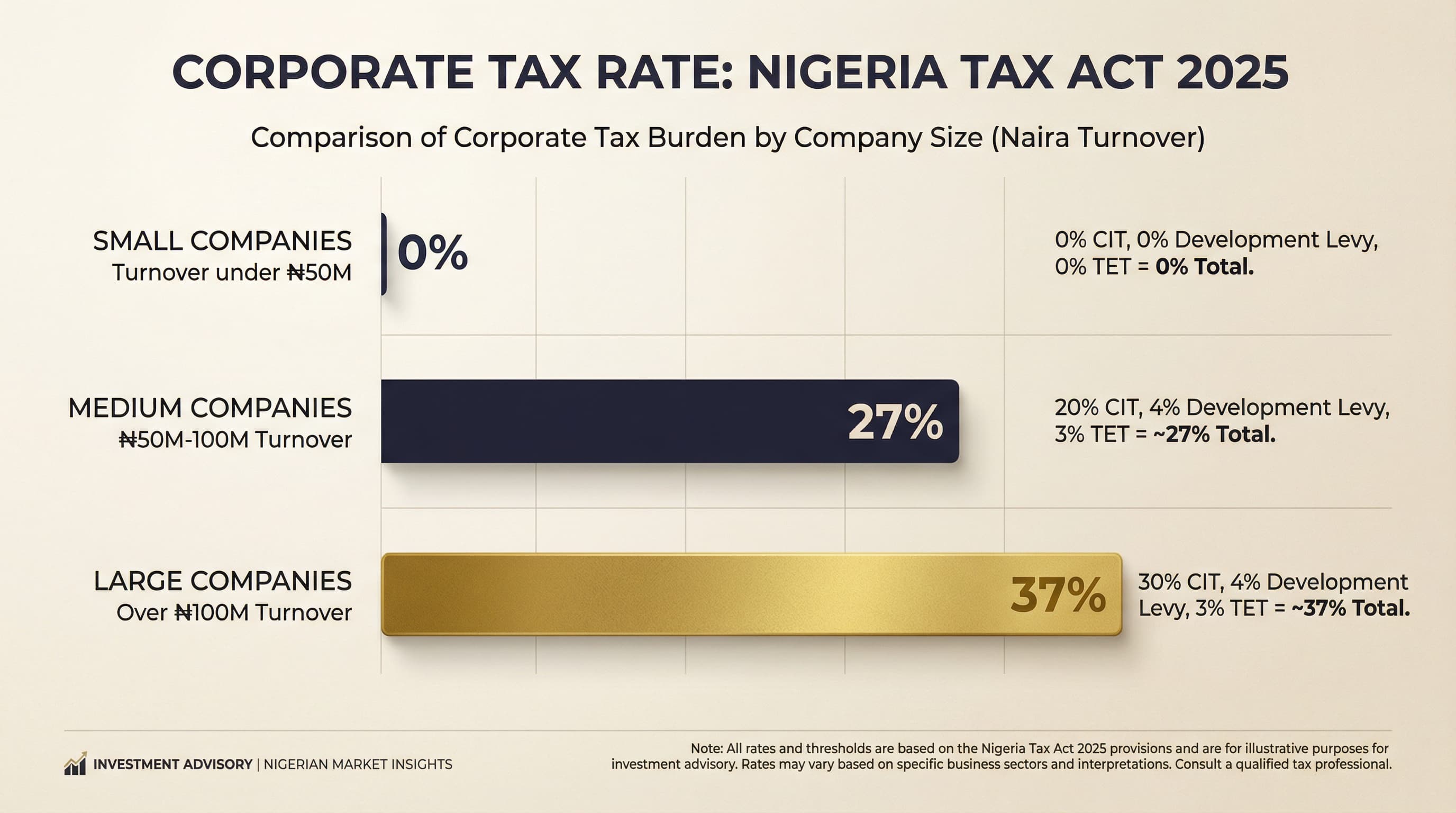

The New Company Size Classification Framework

The Nigeria Tax Act 2025 introduces a tiered taxation system that fundamentally changes how companies are classified and taxed. This is not merely a rate adjustment. It is a structural shift designed to reduce the tax burden on SMEs while ensuring larger enterprises contribute proportionally to national revenue.

How Your Company is Now Classified

The classification depends solely on gross annual turnover, with corresponding tax implications:

Small Companies: Turnover not exceeding ₦50 million. These businesses are now entirely exempt from Companies Income Tax (CIT), Capital Gains Tax (CGT), and the Development Levy. This represents a significant uplift from the previous ₦25 million threshold and means approximately 80% of Nigerian businesses now pay zero income tax.

Medium Companies: Turnover exceeding ₦50 million but not exceeding ₦100 million. These companies pay a reduced CIT rate of 20% on assessable profits. This category captures growing businesses that are beyond the startup phase but not yet operating at institutional scale.

Large Companies: Turnover exceeding ₦100 million. These companies face the standard 30% CIT rate on assessable profits. For businesses at this scale, the full suite of taxes and levies applies, including the Tertiary Education Tax and Development Levy.

Why This Matters for Large Businesses

If your business generates revenue above ₦100 million annually, you fall into the "large company" category. This means:

First, you pay the headline 30% CIT rate on assessable profits. There is no graduation or relief based on approaching the threshold from above.

Second, you are subject to the new 4% Development Levy on assessable profits. This unified levy replaces the previous patchwork of sector-specific levies including the National Information Technology Development Agency (NITDA) levy and Industrial Training Fund contributions.

Third, you must pay the 3% Tertiary Education Tax on assessable profits. This was previously 2.5% under the Tertiary Education Trust Fund Act, so represents an increase for existing large taxpayers.

Fourth, you face enhanced transfer pricing documentation requirements if you engage in transactions with related parties, whether domestic or cross-border.

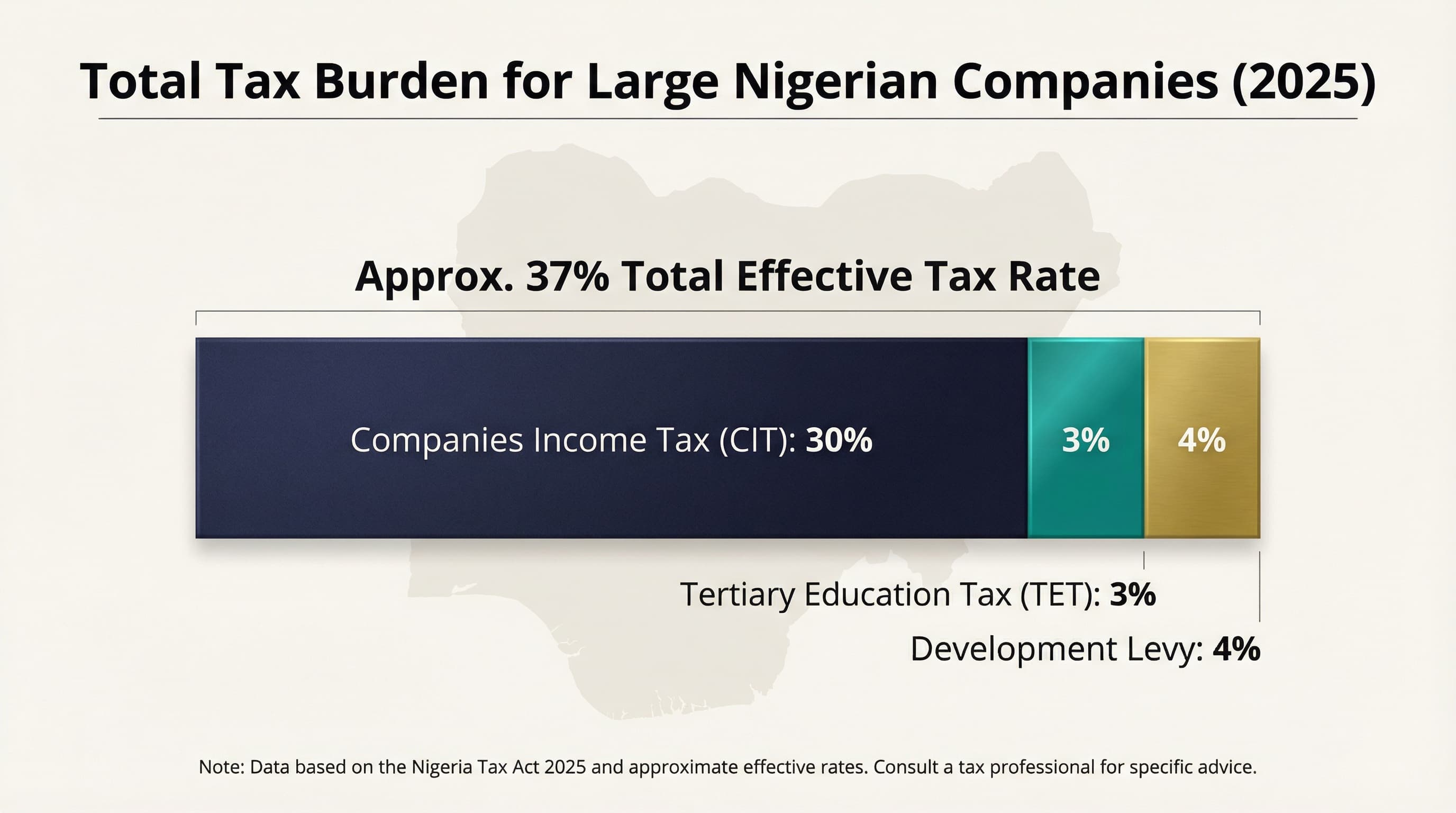

Corporate Income Tax: What Large Companies Pay

For large companies with turnover exceeding ₦100 million, the CIT framework operates as follows:

The 30% Headline Rate

The standard CIT rate remains 30% of assessable profits for large companies. Assessable profits are calculated as total income minus allowable deductions, including:

- Cost of goods sold and operating expenses

- Depreciation and capital allowances (using prescribed rates)

- Interest expenses (subject to new limitations for related party debt)

- Contributions to pension schemes

- Donations to approved institutions (capped at 10% of assessable profits)

Minimum Tax Provisions

Even if your company generates minimal or no taxable profit, you are not exempt from tax obligations. The minimum tax provision ensures that all large companies contribute to the fiscus:

The minimum tax is calculated as 0.5% of gross turnover, less franked investment income. For insurance companies, the calculation is 0.5% of gross premiums or 0.5% of gross income, whichever is higher.

The practical implication: if your calculated CIT liability is less than the minimum tax, you pay the minimum tax instead. This prevents companies from perpetually reporting losses while enjoying the benefits of operating in Nigeria.

The Minimum Effective Tax Rate for Multinationals

Perhaps the most significant change for large multinational enterprises is the introduction of a 15% Minimum Effective Tax Rate (ETR) for certain taxpayers. This provision aligns Nigeria with the OECD/G20 Inclusive Framework on Base Erosion and Profit Shifting (BEPS) Pillar Two.

The rule applies to:

- Constituent entities of multinational enterprise groups with annual global consolidated revenue of at least EUR 750 million

- Large-scale domestic entities meeting the same threshold

If your effective tax rate in Nigeria falls below 15%, you must pay a top-up tax to bridge the gap.

The Development Levy: Understanding the New 4% Charge

The Development Levy represents one of the most significant changes for large businesses. At 4% of assessable profits, this unified levy replaces multiple sector-specific charges that created administrative complexity and compliance uncertainty.

What It Replaces

Previously, large Nigerian businesses faced a patchwork of development-focused levies:

- NITDA Levy: 1% of profit before tax for companies with turnover exceeding ₦100 million

- Industrial Training Fund (ITF) Levy: 1% of annual payroll for employers with 5+ employees

- Police Trust Fund Levy: 0.005% of net profit

- Various sector-specific contributions: Depending on industry classification

How It Now Works

The new Development Levy is calculated as 4% of assessable profits (not revenue). It is:

- Payable by all companies that are not classified as small companies

- Collected by the Federal Inland Revenue Service (FIRS) alongside CIT

- Not deductible when computing assessable profits for CIT purposes

Transfer Pricing: The Tightened Rules

The Nigeria Tax Act 2025 substantially expands the transfer pricing framework, introducing provisions that will affect how multinational groups structure their Nigerian operations.

Interest Deductibility Limitation: The 30% EBITDA Rule

Perhaps the most impactful change for leveraged structures is the new limitation on interest deductibility for related party loans:

The Rule: Interest expense deduction on related party loans (regardless of the lender's jurisdiction) is restricted to 30% of EBITDA.

What This Means: If your Nigerian subsidiary has EBITDA of ₦1 billion, the maximum deductible interest expense on loans from related parties is ₦300 million. Any interest expense exceeding this amount is disallowed for CIT purposes.

Documentation Requirements

Large companies engaging in related party transactions must prepare and maintain contemporaneous transfer pricing documentation:

Local File: Detailed documentation of all material intercompany transactions and the transfer pricing methodology applied.

Master File: An overview of the multinational group's business, including organizational structure and intercompany financial activities.

Country-by-Country Report (CbCR): For groups with consolidated revenue exceeding EUR 750 million, filed via the AEOI Portal by December 31.

Value Added Tax: What Remains and What Changes

The VAT rate remains at 7.5%. However, the Nigeria Tax Act 2025 introduces several modifications:

Expanded Input VAT Recovery

- Services: VAT on all business-related services is now fully recoverable as input VAT

- Capital Assets: VAT paid on qualifying capital expenditure is recoverable

Capital Gains Tax: The Alignment with CIT

Previously, capital gains were taxed at a flat 10% rate. Under the Nigeria Tax Act 2025:

- Companies: CGT now applies at 30%, aligning with the CIT rate

- Individuals: CGT remains at a tiered structure with lower rates

For large companies disposing of capital assets, the tax on gains has tripled from 10% to 30%.

Withholding Tax: Key Rates

Dividends: 10% (may be reduced under DTAs)

Interest: 10% on payments to non-residents and residents

Royalties: 10% on payments to non-residents

Technical and Management Fees: 10% to non-residents; 5% to residents

Professional Services: 5% to residents; 10% to non-residents

Stamp Duty: Simplified at ₦1,000

Stamp duty is now charged at a flat rate of ₦1,000 per agreement or contract, replacing the previous ad valorem 1% rate.

Investment Incentives: The Economic Development Incentive

Companies making qualifying capital expenditure can claim an annual tax credit of 5% of the expenditure for up to 5 years, applied against CIT liability.

Interactive Tax Calculator

Use this calculator to estimate your company's tax liability under the Nigeria Tax Act 2025. Enter your annual revenue and profit margin to see a breakdown of your CIT, levies, and effective tax rate.

Nigeria Corporate Tax Calculator 2025

Estimate your corporate tax liability under the Nigeria Tax Act 2025. Enter your company details below.

Enter your annual turnover/gross revenue

Compliance Deadlines

Annual Returns

CIT Returns: Due within 6 months of the company's financial year-end.

Provisional Tax: Companies must pay provisional tax in instalments during the tax year.

Transfer Pricing Documentation

CbCR Filing: December 31 via the AEOI Portal.

Local and Master Files: Must be prepared contemporaneously and provided to FIRS upon request.

Penalties for Non-Compliance

- Late filing of returns: ₦25,000 for the first month, ₦5,000 for each subsequent month

- Failure to pay tax: 10% penalty plus interest at prevailing CBN rate

- Deliberate misstatement: Removal of statute of limitations

Controlled Foreign Company Rules

The Act introduces CFC rules that attribute income of controlled foreign subsidiaries to the Nigerian parent when:

- The Nigerian company controls the foreign entity

- The foreign entity is resident in a low-tax jurisdiction

- The income is primarily passive (dividends, interest, royalties, capital gains)

Practical Steps for Large Businesses

1. Review Group Financing Structures

Assess the impact of the 30% EBITDA interest limitation on your intercompany financing.

2. Update Transfer Pricing Documentation

Ensure your transfer pricing documentation meets the new standards.

3. Model Your Tax Liability

Use the calculator above or engage professional advisors to model your expected tax liability.

4. Review Asset Disposal Timing

With CGT now at 30% for companies, review planned asset disposals.

5. Engage with FIRS Proactively

The new regime presents opportunities for dialogue with FIRS on interpretation of provisions.

Our Perspective

The Nigeria Tax Act 2025 represents a maturation of Nigeria's tax system. The consolidation into a single statute, the alignment with OECD standards on minimum taxation, and the enhanced transfer pricing framework all signal Nigeria's intent to be taken seriously as a destination for institutional capital.

For large businesses, this means higher compliance costs in the short term but greater certainty in the medium term. The elimination of arbitrary levies and the predictability of a unified framework should reduce the risk premium associated with Nigerian operations.

If you are navigating the Nigeria Tax Act 2025 and need clarity on how these changes affect your business, we welcome the opportunity to discuss. Contact us to schedule a consultation with our team.

Sources & References

- Federal Republic of Nigeria (2025). "Nigeria Tax Act, 2025"

- KPMG Nigeria (2025). "The Nigeria Tax Act (NTA), 2025 Analysis,%202025.pdf)"

- PwC Nigeria (2025). "The Nigerian Tax Reform Acts"

- EY Global (2025). "Nigeria Tax Act, 2025 has been signed"

- Baker Tilly Nigeria (2025). "Nigeria's 2025 Tax Reform Acts Explained"

- Andersen Nigeria (2025). "2025 in Review: Transfer Pricing Developments"

- PwC Tax Summaries (2025). "Nigeria - Corporate - Taxes on corporate income"