Introduction: A Market at an Inflection Point

Let me be direct about something most reports won't tell you: West African real estate is not for everyone, and most investors who enter these markets will lose money. The ones who succeed share specific characteristics: patient capital, genuine local relationships, and an appetite for operational complexity that would make most institutional investors run.

I've watched sophisticated global investors make elementary mistakes in Lagos that they would never make in London. They assume that yield premium compensates for risk without understanding what the risks actually are. They send junior associates to conduct due diligence on transactions that require principals on the ground. They negotiate lease terms in conference calls when the real negotiation happens over dinner in Victoria Island.

The opportunity is real. But the path to capturing it looks nothing like what most pitch decks describe.

Key Takeaways

- Yield premium: 9-11% prime office yields in Lagos vs. 4-5% in London/New York

- Demographic tailwind: 400 million people to be added to West Africa by 2055

- Supply gap: Less than 5% of Lagos commercial stock meets institutional standards

- Currency management: USD-linked leases can hedge 70-80% of FX exposure

- Target markets: Nigeria (scale), Ghana (stability), Côte d'Ivoire (Francophone gateway)

- Expected returns: 18-22% net IRR for well-structured institutional deals

For a visual overview of Africa's investment landscape, the African Development Bank's analysis provides valuable context:

"Africa is home to 60% of the world's uncultivated arable land, 30% of the world's mineral reserves, and the youngest population globally. These fundamentals create structural investment opportunities that will persist for decades."

- African Development Bank, African Economic Outlook 2025

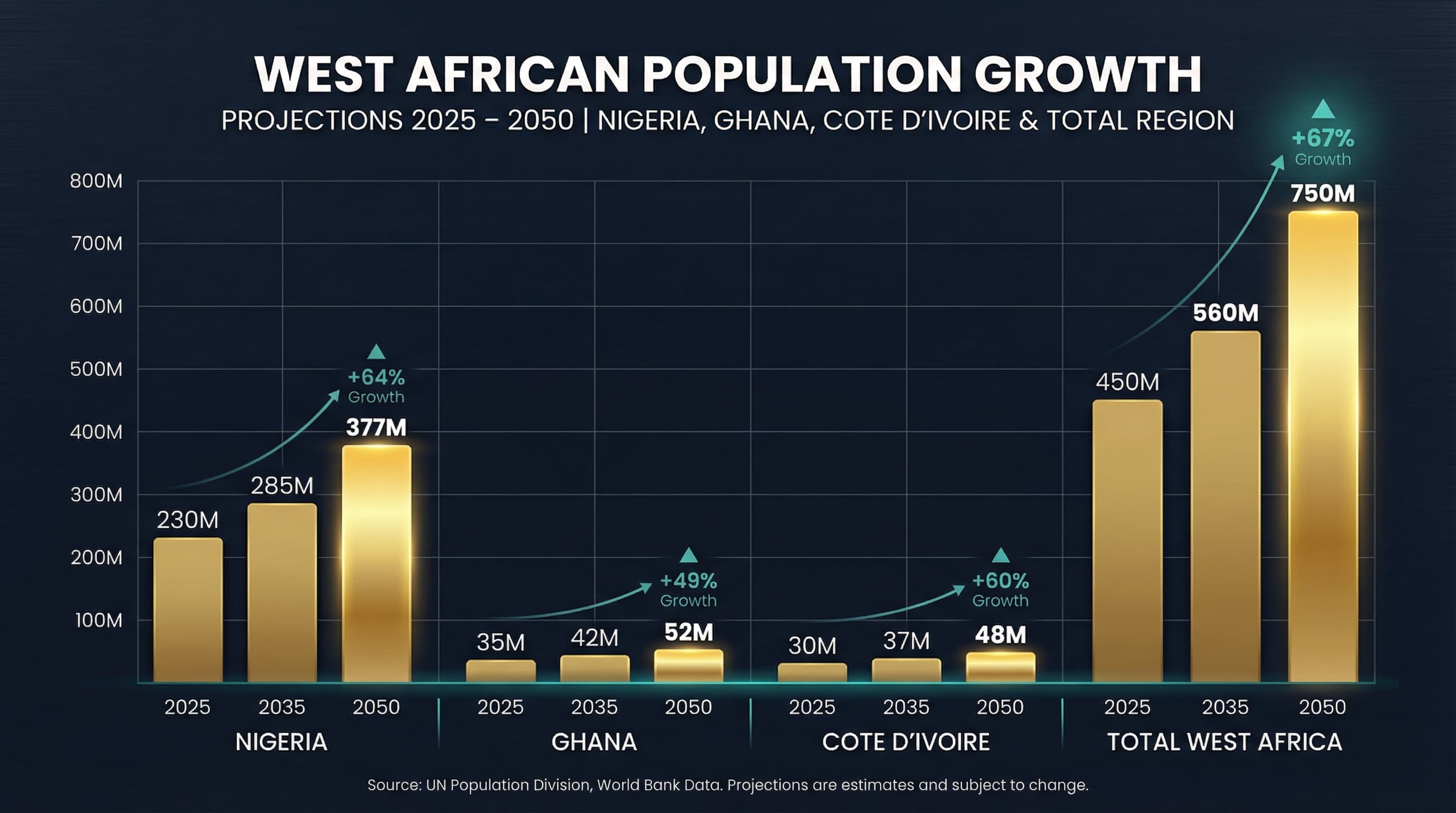

The Demographic Imperative

The numbers are not merely compelling. They represent one of the most significant demographic shifts in human history. According to the United Nations Population Division, West Africa will add approximately 400 million people over the next three decades. Nigeria alone is projected to add 200 million people, making it the world's third most populous country by 2050.

West African Population Projections (Millions):

| Country | 2025 | 2035 | 2050 | Growth Rate |

|---|---|---|---|---|

| Nigeria | 230 | 285 | 377 | +64% |

| Ghana | 35 | 42 | 52 | +49% |

| Côte d'Ivoire | 30 | 37 | 48 | +60% |

| Senegal | 19 | 24 | 33 | +74% |

| Total West Africa | 450 | 560 | 750 | +67% |

Source: UN World Population Prospects 2024

Lagos, currently home to roughly 24 million people, is projected by demographic researchers to become the world's largest city by 2100. The McKinsey Global Institute's research on African urbanization indicates that the continent's urban population will double by 2050, with West Africa leading this transformation.

What This Means for Real Estate: Why the Gap Persists

Office Demand: The supply gap is real, but understanding why it exists matters more than knowing it exists. Lagos has approximately 350,000 square meters of Grade A office stock versus 8 million in Johannesburg. This isn't because developers don't see the opportunity. It's because building institutional-quality assets in Lagos requires solving problems that don't exist in developed markets.

Grade A Office Stock Comparison (Million sq. m):

| City | Grade A Stock | Stock per 1M Population | Gap vs. Johannesburg |

|---|---|---|---|

| Johannesburg | 8.2 | 1.52 | Baseline |

| Nairobi | 1.8 | 0.35 | -77% |

| Lagos | 0.35 | 0.015 | -99% |

| Accra | 0.25 | 0.07 | -95% |

Source: Knight Frank Africa Report 2025, JLL

Why the gap persists: Construction costs in Lagos run 30-40% higher than comparable builds in Johannesburg, primarily due to import dependence for materials (90% of finishing materials are imported), unreliable power requiring expensive backup systems, and a severe shortage of project managers with institutional-grade experience. I've seen $80 million developments stall for 18 months because a single critical piece of MEP equipment was stuck in customs.

Logistics Growth: E-commerce penetration reached 15% in 2025, up from 3% in 2018. But here's what the headline numbers don't show: most "logistics" demand is for informal warehouse space. The number of facilities meeting FMCG or 3PL standards is in the single digits for all of Lagos. The first movers who built proper facilities (40-foot clear heights, proper loading docks, sprinkler ) captured rents 40% above market because there were literally no alternatives.

Residential Development: The 20-million-unit housing deficit is real. But be cautious: most foreign investors who've tried residential development in Nigeria have failed. The mismatch between what middle-class Nigerians can afford (even with mortgages) and what it costs to build to international standards is severe. The success stories are either at the very top (ultra-luxury for the 0.1%) or via creative financing structures like rent-to-own that most foreign investors don't have the operational capacity to execute.

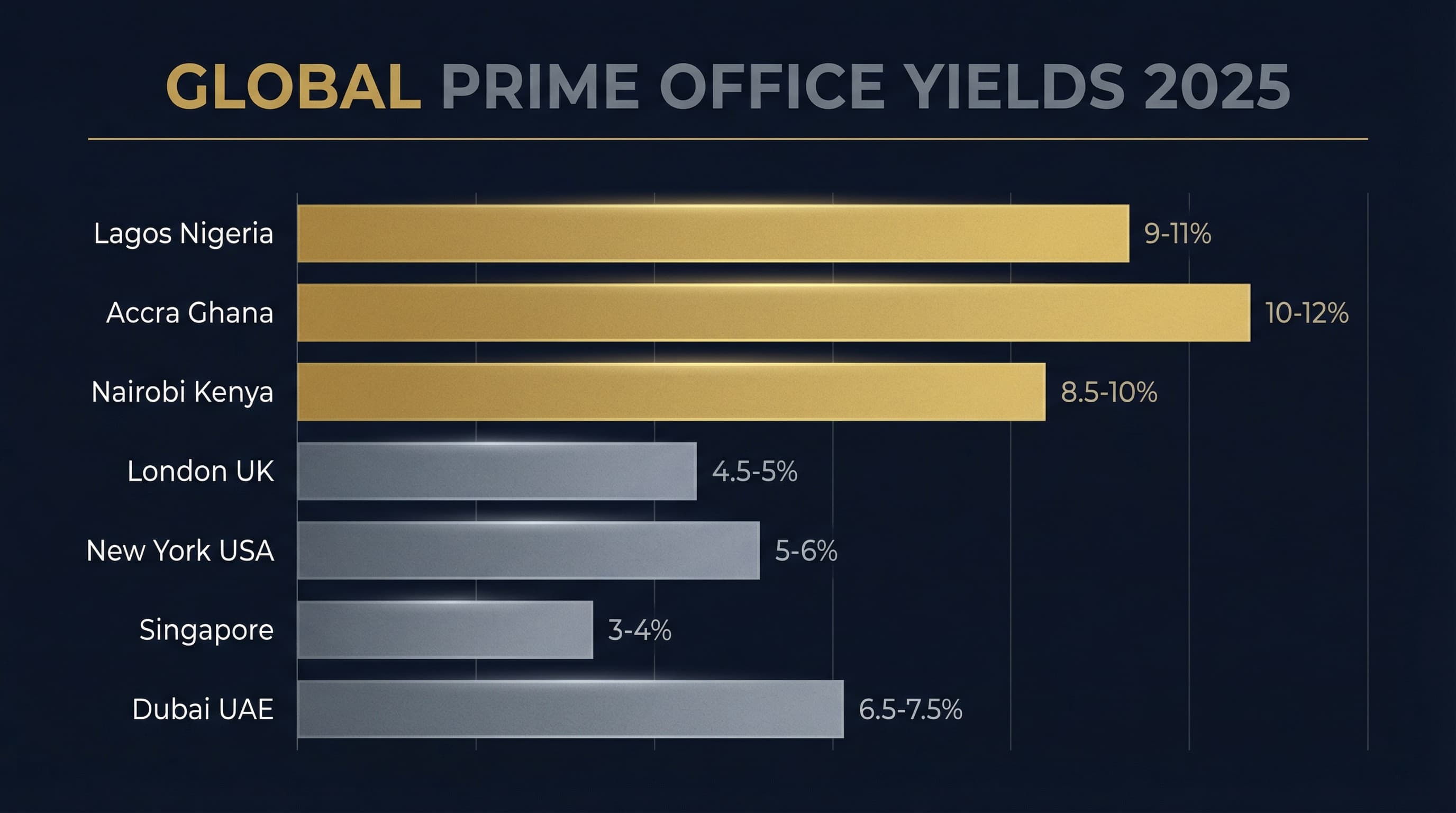

Yield Compression and Return Potential

Nigeria's commercial real estate market has seen significant yield compression over the past five years, yet returns.remain exceptionally attractive by global standards.

Current Market Dynamics

According to Knight Frank's Africa Report 2025, prime office yields in Lagos have compressed from 12-14% in 2019 to 9-11% currently. While this represents meaningful compression, consider the global context:

Global Prime Office Yield Comparison (2025):

| Market | Prime Office Yield | Cap Rate Trend | Vacancy Rate |

|---|---|---|---|

| Lagos, Nigeria | 9.0-11.0% | Compressing | 25-30% |

| Accra, Ghana | 10.0-12.0% | Stable | 20-25% |

| Nairobi, Kenya | 8.5-10.0% | Compressing | 18-22% |

| London, UK | 4.5-5.0% | Expanding | 8-10% |

| New York, USA | 5.0-6.0% | Expanding | 12-15% |

| Singapore | 3.0-4.0% | Stable | 5-7% |

| Dubai, UAE | 6.5-7.5% | Stable | 15-18% |

Source: Knight Frank, JLL, CBRE Global Research 2025

Risk-Adjusted Returns

For well-structured transactions with institutional tenants (oil majors, banks, telecommunications), we observe net IRRs of 18-22% in USD terms. These returns.exist because:

- Capital scarcity: Most global institutional capital cannot or will not access these markets due to mandate restrictions

- Expertise gap: Local capital lacks the sophistication for institutional-grade development

- Supply constraints: The supply of quality assets remains severely constrained by construction costs and financing availability

Historical Return Analysis (2015-2025):

| Strategy | Net IRR (USD) | Multiple | Hold Period |

|---|---|---|---|

| Core Lagos Office | 12-15% | 1.8-2.2x | 7-10 years |

| Value-Add Development | 18-22% | 2.0-2.8x | 5-7 years |

| Logistics/Warehouse | 15-20% | 1.9-2.5x | 5-8 years |

| Residential Development | 20-25% | 2.2-3.0x | 3-5 years |

Source: Actis, Investec, RMB Westport analysis

JLL's 2025 Global Real Estate Transparency Index notes that while West African markets score lower on transparency metrics, the delta between risk perception and actual risk has narrowed significantly over the past decade.

The Institutional Quality Gap

Perhaps the most compelling structural opportunity is the severe shortage of institutional-quality assets. The vast majority of existing commercial stock in West Africa does not meet international standards for:

- Building systems: HVAC, elevators, backup power (essential given grid reliability issues)

- Sustainability certifications: LEED, EDGE, BREEAM

- Tenant amenities: Parking ratios, common areas, fitness facilities

- Lease structures: USD indexation, triple-net terms, parent company guarantees

Supply-Side Constraints

According to Actis, one of the most active institutional investors in African real estate, less than 5% of Lagos's commercial real estate would qualify as institutional grade by developed market standards.

Lagos Commercial Real Estate by Grade:

| Grade | Stock (sq. m) | % of Total | Typical Tenant |

|---|---|---|---|

| Grade A (Institutional) | 350,000 | 4% | MNCs, Embassies, Oil Majors |

| Grade B+ | 800,000 | 10% | Large Nigerian Corporates |

| Grade B | 2,500,000 | 30% | Mid-size Companies |

| Grade C | 4,700,000 | 56% | SMEs, Informal Sector |

Source: Broll Nigeria, Estate Intel 2025

This creates a clear value proposition:

- Develop or acquire assets meeting institutional standards

- Lease to creditworthy multinational tenants on institutional terms

- Capture the premium that global capital will eventually pay for quality

CBRE's research indicates that institutional-quality assets in Lagos trade at 15-20% premiums to comparable buildings, with significantly lower vacancy rates and tenant turnover.

Key Institutional-Grade Developments

Notable institutional-quality assets that demonstrate the market's evolution:

- Landmark Africa, Lagos: 14-story office tower, LEED certified, fully let to multinationals

- One Airport Square, Accra: Ghana's first EDGE-certified commercial building

- Two Rivers Mall, Nairobi: Kenya's largest mall, backed by Old Mutual and Centum

Market-by-Market Analysis

Nigeria: The Giant with Growing Pains

Nigeria represents both the largest opportunity and the most complex market. With GDP of approximately $450 billion, it's Africa's largest economy and offers unmatched scale for real estate investment.

Nigeria Key Metrics:

| Metric | Value | Trend |

|---|---|---|

| GDP (2025) | $450B | Growing 3-4% |

| Population | 230M | +2.5% annually |

| Urbanization Rate | 54% | +4% annually |

| FDI Inflows (2024) | $5.5B | Recovering |

| Inflation Rate | 22% | Moderating |

Source: IMF World Economic Outlook, Central Bank of Nigeria

Lagos Focus Areas:

- Victoria Island/Ikoyi: Premium office and residential

- Lekki Corridor: Emerging commercial hub with new infrastructure

- Apapa/Ikeja: Industrial and logistics

Ghana: The Stable Alternative

Ghana offers political stability and a more mature regulatory environment, though at smaller scale than Nigeria.

Ghana Key Metrics:

| Metric | Value | Trend |

|---|---|---|

| GDP (2025) | $80B | Growing 4-5% |

| Population | 35M | +2.2% annually |

| Urbanization Rate | 58% | +3.5% annually |

| FDI Inflows (2024) | $3.5B | Stable |

| Inflation Rate | 18% | Moderating |

Source: Bank of Ghana, Ghana Statistical Service

Accra Focus Areas:

- Airport City: New commercial district with institutional-grade buildings

- East Legon: Premium residential and retail

- Tema: Industrial port zone

Côte d'Ivoire: Francophone Gateway

As the economic hub of Francophone West Africa, Abidjan offers access to the WAEMU monetary zone with its CFA Franc pegged to the Euro.

Côte d'Ivoire Key Metrics:

| Metric | Value | Trend |

|---|---|---|

| GDP (2025) | $85B | Growing 6-7% |

| Population | 30M | +2.4% annually |

| Currency | CFA Franc | Euro-pegged |

| FDI Inflows (2024) | $1.8B | Growing |

Source: BCEAO, African Development Bank

Currency Considerations and Hedging

The most common objection from international investors concerns currency risk. The Nigerian Naira, in particular, has experienced significant volatility, depreciating roughly 70% against the USD since 2020.

Naira Depreciation History

| Year | NGN/USD Rate | Annual Change |

|---|---|---|

| 2020 | 380 | Baseline |

| 2021 | 410 | -7% |

| 2022 | 445 | -8% |

| 2023 | 780 | -43% |

| 2024 | 1,550 | -50% |

| 2025 | 1,650 | -6% |

Source: Central Bank of Nigeria, Bloomberg

Managing Currency Exposure: What Actually Works

Let me share what I've learned from deals that went wrong:

1. USD-Linked Leases (With Caveats)

Yes, approximately 70% of Grade A office leases in Lagos are nominally USD-linked. But here's what pitch decks don't mention: enforcement is inconsistent. When the Naira crashed 50% in 2024, several major tenants, including well-known , renegotiated their leases rather than pay the contractual USD rate. Some paid in Naira at a negotiated rate; others exited entirely, taking the hit on early termination fees rather than facing a 50% rent increase in local currency terms.

The tenants most likely to honor USD terms: oil majors (Shell, TotalEnergies), major banks with dollar revenue, and embassies. Everyone else is a negotiation.

2. Offshore Structuring: The Repatriation Reality

Yes, Mauritius and Netherlands structures work for dividend repatriation. But the process takes 6-12 months from profit recognition to actual USD in your offshore account. CBN approvals, documentary requirements, and bank processing create a queue that means your cash sits in Lagos far longer than models assume. Build this into your IRR calculations.

3. Local Leverage: A Double-Edged Sword

Naira-denominated debt is theoretically attractive: currency depreciation reduces real debt burden. But local interest rates have averaged 18-25% in recent years. The math only works if depreciation is severe and sustained. And when you need to refinance, local banks will reassess your asset value in Naira, which may have "increased" nominally while declining in USD terms. I've seen investors trapped in refinancing negotiations for over a year.

4. The Hidden Currency Risk: Operating Costs

Your lease may be USD-linked, but your operating costs are in Naira. Diesel for generators, security guards' salaries, maintenance, all local currency. When the Naira crashes, your operating expenses in USD terms drop, boosting short-term cash flow. This creates a false sense of security. When the Naira eventually stabilizes or strengthens (as it periodically does), your margins compress rapidly. Model for this cyclicality.

The 2024-2025 forex reforms have helped. The official/parallel gap dropped from 40%+ to under 5%. But sustainable access to forex at reasonable rates remains the fundamental constraint on institutional development in Nigeria.

Due Diligence Framework: Where Deals Actually Die

Standard due diligence checklists are necessary but insufficient. Let me tell you where deals actually fall apart:

Legal and Title Security

Nigeria Title Framework:

| Document | Purpose | Verification Process |

|---|---|---|

| Certificate of Occupancy (C of O) | Primary ownership proof | Verify at Lands Registry |

| Governor's Consent | Required for transfers | 3-6 month process |

| Survey Plan | Property boundaries | Cross-check with survey records |

| Building Approval | Construction legality | Verify with planning authority |

What the Table Doesn't Tell You

The Omo-Onile Problem: Even with a clean C of O, you may face claims from "original owners" (omo-onile) whose families sold the land generations ago. This isn't about legal validity. Your title may be bulletproof in court. It's about the operational reality of construction and tenancy. I know of a $40 million development that sat empty for 8 months because omo-onile physically blocked the site entrance until a "settlement" was negotiated. Budget for this. It's not corruption; it's how the system works.

Governor's Consent Timing: The "3-6 month process" in the table is optimistic for complex transactions. I've seen Governor's Consent take 14 months on a straightforward deal because the file sat in queue. Your deal structure must account for this. Don't commit to closing timelines you can't control. And the consent fee (typically 3-5% of property value in Lagos) is negotiable within reason.

Registry Chaos: Lagos has multiple land registries with incomplete, sometimes contradictory records. The Lands Bureau, Land Registry, Survey Department, and Town Planning Authority don't always synchronize. I've seen properties with valid C of O's that somehow don't appear in the official survey records. Hire local counsel who knows which registry staff to consult and how to resolve discrepancies. This is relationship work, not just document review.

What "Physical Survey" Really Means: Don't just verify boundaries. Check for unauthorized structures, squatters, ongoing construction disputes with neighbors, and, critically,whether the access road is actually public or crosses someone else's property. An otherwise perfect site is worthless if your access depends on a neighbor's goodwill.

Counterparty Assessment

| Factor | Assessment Criteria | Red Flags |

|---|---|---|

| Local Partner | Track record, reputation, references | Litigation history, regulatory issues |

| Contractor | Completed projects, financial stability | Cost overruns, delays on prior projects |

| Property Manager | Portfolio under management, tenant references | High vacancy rates, disputes |

Exit Strategy Planning

Unlike developed markets, West African real estate has limited secondary market liquidity. Realistic exit planning must consider:

- Potential acquirers: Local pension funds (Nigeria's pension assets exceed $15B), regional REITs, sovereign wealth funds

- Hold period assumptions: Typically 7-10 years for core assets

- Exit timing: Align with economic cycles and currency stability periods

Regulatory and Tax Landscape

Nigeria

Key Tax Considerations:

| Tax | Rate | Notes |

|---|---|---|

| Corporate Tax | 30% | Reduced to 25% for small companies |

| Capital Gains Tax | 10% | On disposal of real property |

| Withholding Tax | 10% | On rent payments |

| VAT | 7.5% | On commercial transactions |

| Stamp Duty | 1.5-3% | On property transfers |

Source: FIRS Nigeria

Tax Incentives:

- Pioneer status available for certain real estate developments

- Free trade zone exemptions for qualifying properties

- Double taxation treaty benefits through proper structuring

Ghana

Key Tax Considerations:

| Tax | Rate | Notes |

|---|---|---|

| Corporate Tax | 25% | Standard rate |

| Capital Gains Tax | 15% | On property disposals |

| Withholding Tax | 8% | On rent payments |

| VAT | 15% | Plus levies totaling ~17.5% |

Source: Ghana Revenue Authority

Key Takeaways

- Demographic tailwinds are locked in: 400 million additional people in West Africa by 2055 is not a projection. It's demographic momentum that cannot be reversed

- Yield premium persists: 9-11% yields versus 4-5% in developed markets compensates for additional risk while offering substantial return potential

- Institutional gap creates opportunity: Less than 5% of commercial stock meets institutional standards. First movers capture quality premium

- Currency risk is manageable: USD-linked leases and proper structuring can mitigate 70-80% of currency exposure

- Due diligence is critical: Success requires local expertise, rigorous process, and longer time horizons than developed markets

- Market timing matters: Post-reform Nigeria and stable Ghana offer attractive entry points in 2025

The Honest Case: Who Should Stay Away

This market is not appropriate for:

- Investors who need quarterly liquidity or predictable distributions

- Committees that require institutional-quality reporting (you won't get it from local managers)

- Anyone uncomfortable with a 10+ year hold period

- Capital that can't absorb a 50% currency shock without panic

- Investors who send associates instead of principals to the market

This market is compelling for:

- Patient family office capital with 20+ year horizons

- Investors with existing Africa exposure seeking geographic diversification within the continent

- Those with genuine local relationships (not "local partners" identified through a database)

- Opportunistic capital willing to take development risk for outsized returns

- Strategic investors who see real estate as part of a broader Africa thesis

The yields are real. The demographic tailwinds are real. But so are the operational challenges, currency risk, and exit constraints. Anyone telling you otherwise, including pitch decks with neat IRR projections, is selling you something.

For those interested in MENA capital as a source of funding for African investments, see our guide to Understanding Gulf Investors.

If you have the right capital structure, time horizon, and risk appetite, West Africa offers genuine alpha. Contact us for a candid conversation about whether this market fits your portfolio.

Sources & References:

- United Nations Population Division (2024). "World Population Prospects 2024"

- McKinsey Global Institute (2025). "Lions on the Move III: Africa's Economic Resurgence"

- Knight Frank (2025). "Africa Report 2025"

- JLL (2025). "Global Real Estate Transparency Index"

- World Bank (2025). "Africa's Pulse: Economic Analysis"

- CBRE (2025). "Africa Commercial Real Estate Outlook"

- IMF (2025). "World Economic Outlook Database"

- Central Bank of Nigeria (2025). "Economic Reports"

- African Development Bank (2025). "African Economic Outlook"

- Actis (2025). "African Real Estate Investment Thesis"