Introduction: Why Most Western Managers Fail in the Gulf

I'm going to share something that Western managers find uncomfortable: the Gulf doesn't need you. GCC sovereign wealth funds and family offices have access to every top-tier manager globally. They're courted by Blackstone, Apollo, and KKR. They co-invest alongside Harvard's endowment. They have relationships with managers whose returns.you aspire to match.

When a Western manager approaches the Gulf thinking they're offering an opportunity, they've already failed. You are not offering them anything they can't get elsewhere, probably with better terms and a longer track record.

What you can offer, and what creates genuine , is something different: access to a niche they don't have, a relationship that goes beyond transactions, and respect for how business actually works in their world.

The GCC collectively manages over $4.5 trillion in sovereign wealth, plus an estimated $1-2 trillion in family office capital. But capital doesn't allocate to managers; people allocate to people. And the people who control this capital operate in a cultural context that most Western managers fundamentally misunderstand.

This guide is about what I've learned, often , about how to build genuine relationships in the Gulf, and why most of what you've read about "doing business in the Middle East" will lead you astray.

Key Takeaways

- Scale: $6-7 trillion in allocable capital across GCC sovereign wealth and family offices

- Relationships first: Plan for 2-5 years of cultivation before expecting capital commitment

- Principal preservation: 68% of Gulf family offices rank capital preservation as #1 priority (vs. 34% in US)

- Alignment matters: GP commitment of 3-5%+ expected; fee scrutiny is intense

- Sharia opportunity: $3.3 trillion Islamic finance market growing 9% annually. Compliance opens doors

- Timing: Best months for roadshows are October through early March; avoid summer and Ramadan

Gulf investors operate within a fundamentally different cultural and commercial framework than their Western counterparts. Understanding these differences isn't about stereotyping or oversimplification. It's about respecting a distinct approach to wealth stewardship that has developed over generations.

The Scale of Gulf Capital

Before discussing strategy, it's important to understand the magnitude of capital concentration in the GCC.

Major GCC Sovereign Wealth Funds (2025):

| Fund | Country | AUM (Est. $B) | Focus Areas |

|---|---|---|---|

| Abu Dhabi Investment Authority (ADIA) | UAE | $990 | Global diversified |

| Kuwait Investment Authority (KIA) | Kuwait | $750 | Global diversified |

| Public Investment Fund (PIF) | Saudi Arabia | $930 | Vision 2030, diversification |

| Qatar Investment Authority (QIA) | Qatar | $510 | Global diversified, sports |

| Mubadala | UAE | $302 | Technology, aerospace, healthcare |

| Investment Corporation of Dubai | UAE | $280 | Financial services, infrastructure |

| Abu Dhabi Developmental Holding | UAE | $195 | Regional development |

| **Total Major SWFs** | **$3,957** |

Source: Sovereign Wealth Fund Institute 2025

Beyond Sovereign Wealth:

| Capital Pool | Estimated AUM ($B) | Key Characteristics |

|---|---|---|

| Sovereign Wealth Funds | $4,000+ | Long-term, diversified, institutional |

| Family Offices | $1,500-2,000 | Relationship-driven, principal preservation |

| Insurance/Pension | $400-500 | Regulatory constraints, liability matching |

| Banks/Corporations | $300-400 | Short-term, credit-focused |

| **Total Allocable** | **$6,000-7,000** |

Source: Knight Frank Wealth Report 2025, Proteus estimates

The Relationship Paradigm: What Actually Happens

In New York, you have a meeting, exchange data, and schedule follow-ups. In Abu Dhabi, you have coffee for an hour, discuss everything except business, and leave wondering if anything happened.

Something did happen. You were being evaluated. Not your fund, but you. And if you tried to steer the conversation to your pitch deck, you failed the evaluation.

The "Test" Meetings You Don't Realize Are Tests

Here's what typically happens with a new Western manager:

Meeting 1: You're invited for coffee. You discuss family, travel, mutual acquaintances. No business. The meeting ends with warm but vague pleasantries. You leave confused.

Reality: You just had an evaluation meeting. Everything you said was noted. Not formally, but absorbed. Did you show genuine curiosity about them? Did you dominate the conversation? Did you check your phone? Were you comfortable with silence? Were you impatient?

Meeting 2 (if you passed): 3-4 months later. Similar format, but now with a few minutes discussing your fund, at their initiation. Still no commitment or timeline.

Meeting 3 (if you passed): Now you might meet a more senior family member or colleague. The actual decision-maker starts to form an impression. Still months away from anything substantive.

According to research from INSEAD's Middle East campus, GCC business relationships typically require 3-5 years of cultivation before significant capital deployment. This isn't inefficiency. It's risk management. They're testing whether you're a transactional relationship or a genuine one. And they can afford to be patient.

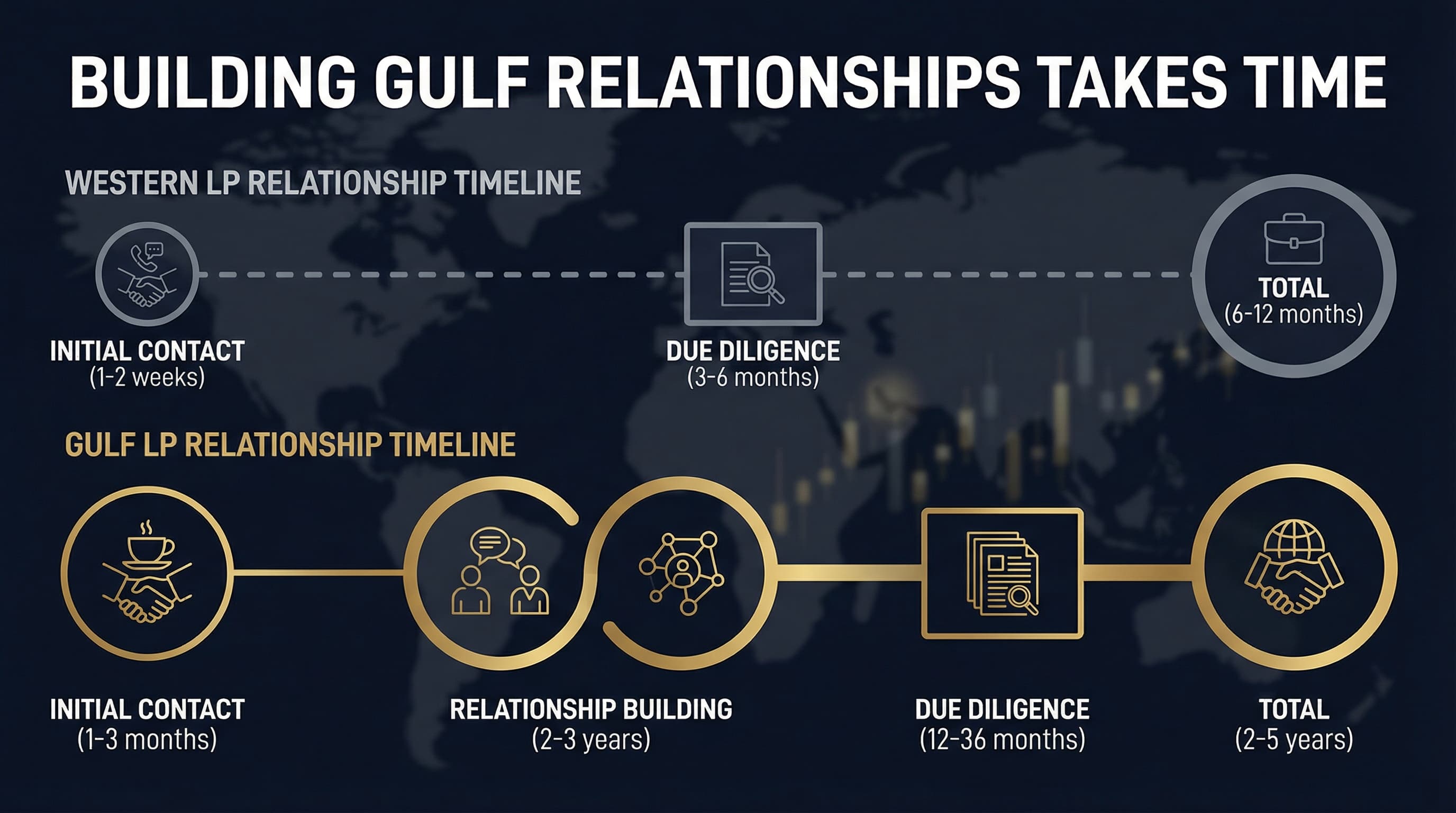

Relationship Timeline Comparison:

| Stage | Western LP | Gulf LP |

|---|---|---|

| Initial contact to first meeting | 1-2 weeks | 1-3 months |

| First meeting to follow-up | 1-2 weeks | 2-4 months |

| Due diligence to commitment | 3-6 months | 12-36 months |

| First investment to re-up | 4-5 years | 5-10 years |

| **Total relationship before commitment** | **6-12 months** | **2-5 years** |

What "No" Looks Like: Other Things Western Managers Miss

Gulf business culture avoids direct confrontation. A Western LP will tell you "we're not investing in your fund." A Gulf LP will never say this. Understanding what "no" sounds like is critical:

| What They Say | What It Means | What You Should Do |

|---|---|---|

| "Let's stay in touch" | Probably no | Send quarterly updates, don't push |

| "Interesting. Let me think about it" | Leaning no | Don't follow up for 3-4 months |

| "We need to check with the family" | Could go either way | Be patient; you're being discussed |

| "When are you next in Dubai/Riyadh?" | Positive signal | Schedule the trip immediately |

| "You should meet my cousin/colleague" | Strong positive | The relationship is expanding |

| Silence after meeting | Could be no or processing | Wait longer than you're comfortable with |

Cultural Mistakes That Kill Deals:

- Sending your head of IR instead of yourself. This signals: "You're not important enough for my time." Expect no response.

- Following up too quickly. A Monday meeting followed by a Wednesday email asking for "next steps" reads as desperate and transactional. Wait 2-3 weeks minimum.

- Declining hospitality. If you're offered coffee, dates, or lunch, accept. Declining signals discomfort with the relationship.

- Checking your watch or phone. Gulf meetings are not scheduled by the hour. If the conversation is flowing, you stay. Looking impatient signals you don't value them.

- Bringing a lawyer or detailed term sheet to early meetings. This signals you see them as a transaction, not a relationship. Legal details come after trust is established.

4. The Majlis Culture

The traditional majlis (sitting room) remains central to Gulf business culture. An invitation to a majlis, especially a private family one, signals you've passed significant evaluation. This is where real decisions are shaped, though never explicitly stated. If you're invited, accept. Clear your schedule. Show up having done research on the family and their interests.

The Abu Dhabi Investment Authority (ADIA) is known for relationships with managers spanning decades. Their current GP roster includes managers they began meeting in the 1990s.

Principal Preservation: A Cultural Priority

Western asset management emphasizes return maximization within risk constraints. Gulf wealth management prioritizes principal preservation as a primary objective, with return generation secondary.

Historical and Cultural Context

This orientation emerges from the cultural and religious context of wealth in Islamic societies. Wealth is considered an amanah (trust) to be preserved and transmitted across generations. The concept of reckless return-chasing conflicts with deeply held values around stewardship.

Gulf vs. Western Investment Priorities:

| Priority | Gulf Family Offices | US Family Offices | European FOs |

|---|---|---|---|

| Capital Preservation | 68% (Primary) | 34% | 42% |

| Return Maximization | 18% | 45% | 38% |

| Generational Transfer | 42% | 28% | 35% |

| ESG/Impact | 22% | 31% | 45% |

Source: PwC Middle East Private Wealth Survey 2025

Investment Implications

Conservative Leverage: Gulf investors typically prefer unlevered or modestly levered strategies. A 2x levered buyout fund may face more scrutiny than a 0.5x infrastructure vehicle.

Tangible Assets: Strategies tied to physical assets (real estate, infrastructure, agriculture) resonate more strongly than financial engineering or multiple arbitrage.

Downside Focus: When presenting track record, emphasize capital preservation statistics as prominently as returns.

| Metric to Highlight | Why It Matters to Gulf LPs |

|---|---|

| Loss ratio (% of deals with losses) | Direct measure of principal preservation |

| Downside deviation | Risk asymmetry matters |

| Maximum drawdown | Worst-case scenario visibility |

| Recovery time after losses | Resilience demonstration |

| Capital returned vs. called | Liquidity and principal return |

Realistic Targets: Aggressive return targets can be red flags. A manager targeting 15% net returns.with demonstrated downside protection is often more attractive than one targeting 25% with volatile historical performance.

Alignment and Fee Sensitivity

Gulf investors have significant experience with Western managers, and that experience has not always been positive. Stories of managers who extracted substantial fees while delivering mediocre returns.circulate within the region's investment community.

The Trust Deficit

This history creates heightened sensitivity to alignment issues. Gulf investors scrutinize:

Alignment Factors and Gulf LP Expectations:

| Factor | Standard Terms | Gulf LP Expectation | Why |

|---|---|---|---|

| GP Commitment | 1-2% of fund | 3-5%+ of fund | Skin in the game |

| Management Fee | 2% | 1.5-1.75% | Fee efficiency |

| Carry | 20% | 20% (with hurdle) | Performance alignment |

| Hurdle Rate | 8% | 8%+ preferred | Return threshold |

| Clawback | LP-favorable | Strong clawback | Principal protection |

| Co-Invest Rights | Case-by-case | Guaranteed access | Direct exposure |

Demonstrating Alignment

- Commit significant GP capital (3-5% of fund size is increasingly expected)

- Consider fee structures that emphasize performance over asset accumulation

- Be transparent about all fee arrangements, including portfolio company fees

- Offer co-investment rights that allow LPs to increase exposure to best opportunities

- Provide full clawback provisions that protect LP principal

Investcorp, one of the most successful Middle East-origin alternative asset managers, has built its LP base in part through alignment structures that give investors meaningful downside protection and upside participation.

Sharia Compliance: Opportunity, Not Obstacle

Many, though not all, of Gulf investors require investment structures that comply with Islamic finance principles. Western managers often view this as an obstacle; sophisticated managers recognize it as a source of differentiation.

The Scale of Islamic Finance

Global Islamic Finance Market (2025):

| Segment | Market Size ($B) | Growth Rate |

|---|---|---|

| Islamic Banking | $2,100 | 8% annually |

| Sukuk (Islamic Bonds) | $900 | 12% annually |

| Islamic Funds | $250 | 15% annually |

| Takaful (Insurance) | $60 | 10% annually |

| **Total** | **$3,310** | **9% overall** |

Source: Global Islamic Finance Report 2025

Core Principles

Sharia-compliant investing generally requires:

- Prohibition of Riba (Interest): Conventional debt structures must be replaced with profit-sharing or asset-backed alternatives

- Prohibition of Gharar (Excessive Uncertainty): Speculative instruments and excessive leverage are restricted

- Sector Exclusions: Investments in alcohol, gambling, conventional banking, adult entertainment, and weapons are prohibited

- Asset-Backing: Financial structures should be tied to tangible underlying assets

Practical Implementation

Creating Sharia-compliant fund structures is more straightforward than many managers assume:

Common Sharia-Compliant Structures:

| Structure | Description | Common Use Case |

|---|---|---|

| Murabaha | Cost-plus financing | Acquisition financing |

| Ijara | Lease-to-own arrangement | Real estate, equipment |

| Musharaka | Profit-sharing JV | Private equity, partnerships |

| Mudaraba | Manager/investor partnership | Fund structures |

| Sukuk | Asset-backed certificates | Debt replacement |

| Istisna | Construction financing | Development projects |

Strategic Advantage

Managers willing to accommodate Sharia requirements access capital pools that many competitors cannot. For those investing in West African real estate or African infrastructure, Sharia-compliant structures are particularly relevant given the Islamic populations in target markets.

Country-by-Country Guide

Each GCC country has distinct characteristics that affect fundraising strategy.

Saudi Arabia: The Emerging Giant

Key Characteristics:

| Factor | Details |

|---|---|

| Primary Capital Source | Public Investment Fund ($930B) |

| Decision Timeline | 18-24 months typical |

| Key Focus Areas | Vision 2030 alignment, local content |

| Access Point | Riyadh |

| Cultural Notes | Conservative, formal, Arabic preferred |

The Kingdom's Vision 2030 has transformed the investment landscape. PIF's mandate to deploy capital domestically and internationally creates opportunities for managers with Saudi relevance.

UAE: The Established Hub

Key Characteristics:

| Factor | Details |

|---|---|

| Primary Capital Sources | ADIA, Mubadala, family offices |

| Decision Timeline | 12-18 months |

| Key Focus Areas | Global diversification, technology |

| Access Points | Abu Dhabi (sovereign), Dubai (family offices) |

| Cultural Notes | More cosmopolitan, English common |

The UAE remains the most accessible GCC market for Western managers, with established infrastructure for financial services and a concentration of family offices in Dubai.

Qatar: The Concentrated Allocator

Key Characteristics:

| Factor | Details |

|---|---|

| Primary Capital Source | Qatar Investment Authority ($510B) |

| Decision Timeline | 18-24 months |

| Key Focus Areas | Strategic assets, sports, luxury |

| Access Point | Doha |

| Cultural Notes | Highly selective, relationship-intensive |

QIA makes concentrated bets in high-profile assets. Managers with unique access or expertise in target sectors may find receptive audiences.

Kuwait: The Conservative Allocator

Key Characteristics:

| Factor | Details |

|---|---|

| Primary Capital Source | Kuwait Investment Authority ($750B) |

| Decision Timeline | 24-36 months |

| Key Focus Areas | Conservative strategies, fixed income |

| Access Point | Kuwait City |

| Cultural Notes | Traditional, deliberate decision-making |

KIA is known for conservative allocation and long-term relationships. Patience is particularly important in this market.

The Regional Calendar

Understanding the GCC calendar is essential for effective engagement.

Key Periods and Implications:

| Period | Timing (Approx.) | Business Impact |

|---|---|---|

| Ramadan | March-April (varies) | Reduced hours, evening meetings |

| Eid al-Fitr | After Ramadan | 1-2 week holiday, no business |

| Summer | June-August | Many travel abroad, slower pace |

| Eid al-Adha | June (varies) | 1-2 week holiday |

| Hajj Season | Around Eid al-Adha | Key personnel may be traveling |

| Q4 | October-December | Peak business activity |

| Q1 | January-March | Strong business activity |

Best Times for GCC Roadshows:

- October through early March (excluding Ramadan and Eid periods)

- Worst times: Summer months, Ramadan, major holidays

Key Takeaways

- Relationships precede transactions: Plan for 2-3 years of cultivation before expecting capital

- Principal preservation is paramount: 68% of Gulf family offices rank this as #1 priority

- Alignment matters intensely: GP commitment of 3-5%+ expected, scrutinize all fee arrangements

- Sharia compliance opens doors: $3.3 trillion Islamic finance market growing 9% annually

- Country strategies differ: Saudi (Vision 2030), UAE (diversified hub), Qatar (concentrated bets), Kuwait (conservative)

- Calendar awareness essential: Time visits for October-March, avoid summer and religious holidays

- Physical presence non-negotiable: The region cannot be accessed remotely or through junior staff

Reality Check: Is Gulf Capital Right for Your Fund?

Before investing years in Gulf relationships, ask yourself honestly:

Gulf capital is right for you if:

- You have a genuine long-term orientation (not "long-term" in pitch decks, but actually patient)

- Your strategy offers something not available from mega-GPs (niche access, emerging market expertise, specific sector knowledge)

- You or your team can be in the region regularly. Not annually, quarterly

- You're comfortable with ambiguity and slow timelines

- You're building an institution, not maximizing short-term economics

Gulf capital is wrong for you if:

- You're trying to fill a Fund I close on a deadline

- You view MENA as "one more geography to cover" rather than a market to understand

- You're planning to send IR to manage the relationships after initial meetings

- Your fund structure or sector has Sharia compliance challenges you can't solve

- You're uncomfortable with relationship-building that doesn't tie directly to commitments

Most Western managers should not pursue Gulf capital. The opportunity cost of years of cultivation, when the same energy could build relationships with US family offices or European institutions that move faster, is significant.

If you have the right strategy, time horizon, and cultural orientation, and if you're willing to invest years before seeing , Gulf capital can be transformative. It tends to be patient, relationship-driven, and loyal to managers who earn their trust.

For complementary insights on fundraising best practices, see our guide for emerging managers.

If you want an honest assessment of whether Gulf capital makes sense for your fund, contact us. We'll tell you if you're wasting your time, before you waste years finding out.

Sources & References:

- Sovereign Wealth Fund Institute (2025). "Global SWF Rankings"

- Knight Frank (2025). "The Wealth Report: Middle East Edition"

- INSEAD (2025). "Business Culture in the Middle East"

- PwC (2025). "Middle East Private Wealth Survey"

- Global Islamic Finance Report (2025). "State of the Global Islamic Economy"

- KPMG (2025). "GCC Family Business Survey"

- Bloomberg (2025). "Gulf Sovereign Wealth Tracker"

- Gulf News (2025). "Regional Business Analysis"

- McKinsey (2025). "Saudi Arabia Beyond Oil"

- Preqin (2025). "Middle East Investor Outlook"