Introduction: The Weaponization of Resources

The era of commodity markets operating on pure supply-demand economics is ending. Critical materials have become instruments of statecraft, with producing nations leveraging resource control for strategic advantage.

This transformation is structural, not cyclical. The green energy transition requires 4-6x current mineral production by 2040. Semiconductor manufacturing depends on materials concentrated in a handful of countries. Agricultural exporters face climate volatility and food security pressures. Each dynamic creates leverage for resource holders and vulnerability for resource consumers.

This analysis is part of our Modern Mercantilism research series, examining how state-driven economics is reshaping global markets.

Key Takeaways

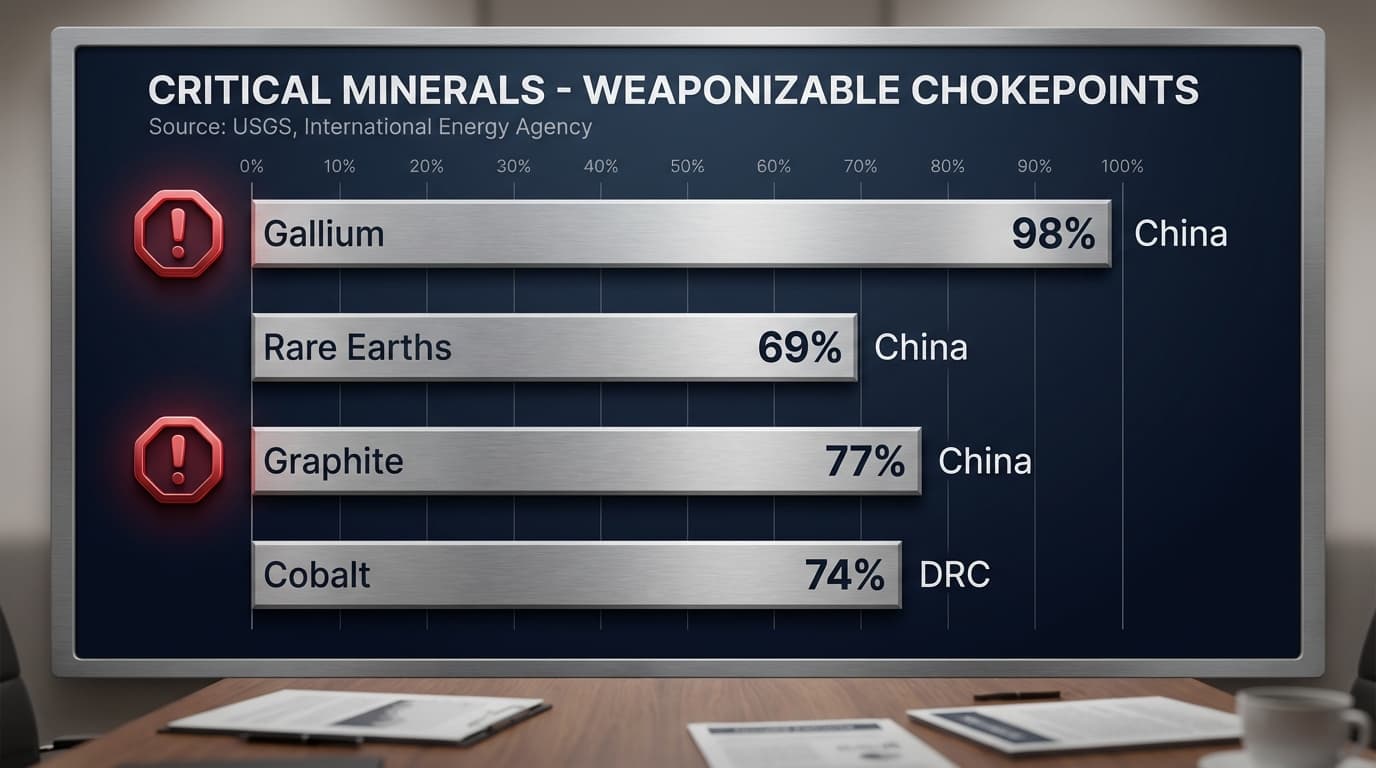

- Extreme production concentration: Ten of fifteen critical minerals show 60%+ concentration in single countries, granting one-veto-power dynamics to producing nations

- China's resource weaponization: 75% probability of GaN wafer export controls by 2026, following the gallium and germanium export bans already implemented

- Petrodollar erosion: 30% probability that Russia prices 50%+ of oil exports in non-USD currencies by 2030, breaking the 50-year dollar dominance in energy trade

- Food security nationalism: 70% probability of coordinated G20 agricultural export quotas following major climate events by 2027

- Africa's resource leverage: Nigeria positioned to impose lithium export duties by 2028, replicating Indonesia's successful nickel model

- Defense supply chain mandate: US will likely require critical defense systems to contain less than 10% Chinese rare earth content by 2029

The Concentration Problem

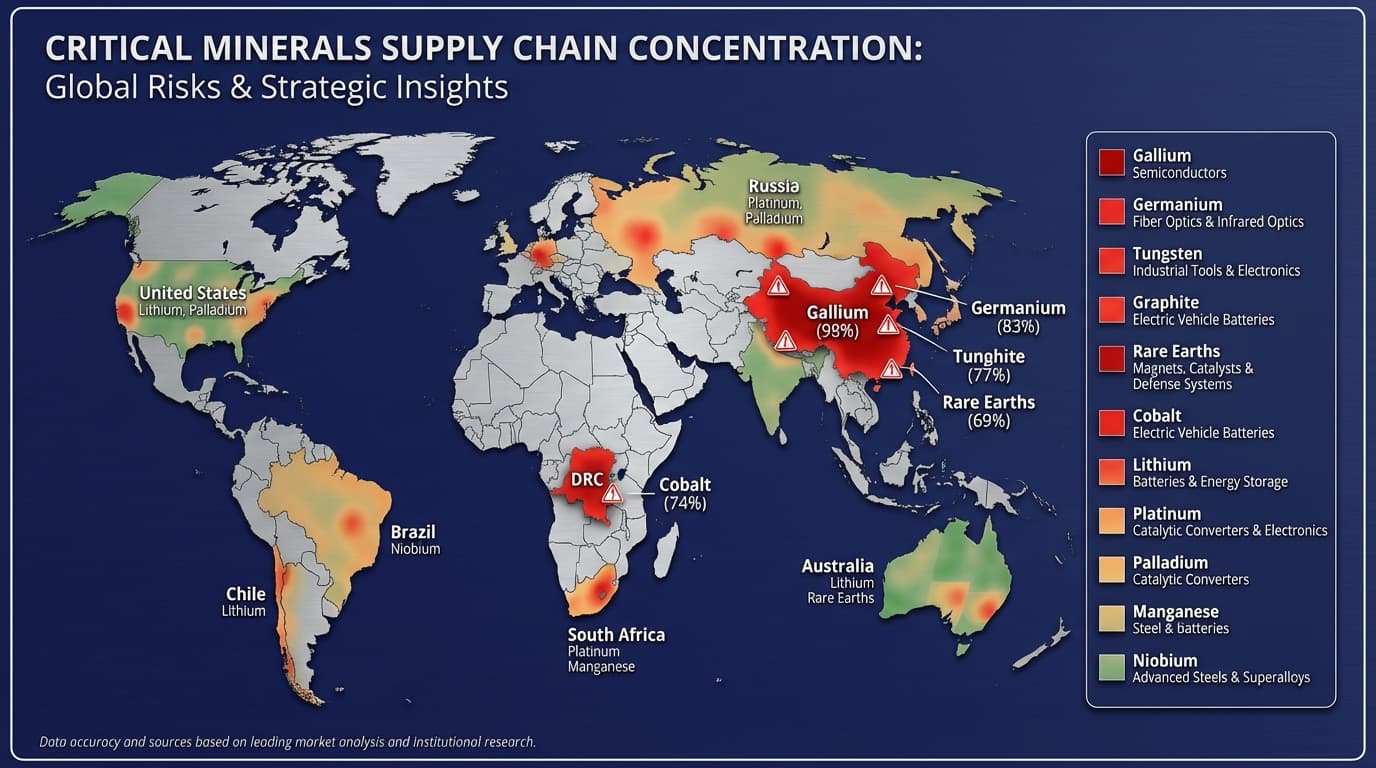

Resource nationalism derives its power from geological concentration. Ten of fifteen critical minerals show 60%+ production concentration in single countries. China dominates rare earths (69%), gallium (98%), and graphite (77%). DRC controls 74% of cobalt. Indonesia captured 56% of nickel through export bans.

The multiplier effect compounds the risk. China's 69% mining share in rare earths becomes 85%+ in processing, creating dual chokepoints. A nation controlling both extraction and refining can throttle global supply at multiple points.

The Chokepoint Map

The concentration is staggering. Gallium, essential for radar systems, 5G infrastructure, and power electronics, is 98% Chinese. Germanium, critical for fiber optics and infrared technology, is 83% Chinese. Tungsten, used in everything from cutting tools to military projectiles, is 82% Chinese. These aren't obscure materials with easy substitutes; they're foundational to modern technology.

Seven of these fifteen critical minerals already face active export controls. China banned gallium and germanium exports in late 2023, a direct retaliation for US semiconductor restrictions. Graphite controls followed. The pattern is clear: materials that were once freely traded commodities are becoming strategic weapons.

The DRC controls 74% of cobalt, essential for batteries. Indonesia, through aggressive export bans on raw nickel ore, captured 56% of global nickel processing and forced $30 billion in smelter investment onto its shores. Platinum (71% South Africa) and lithium (split between Australia and Chile) remain uncontrolled for now.

Historical pattern: each restriction triggers 50-150% price spikes within six months. When China restricted rare earth exports in 2010, prices surged 10x. The 2023 gallium restrictions caused immediate scrambling among Western chipmakers. With the green transition requiring 4-6x current mineral production by 2040, these chokepoints become the primary geopolitical flashpoints of the coming decade.

Forecast 1: LNG Pricing Shift from Henry Hub

70% probability: By 2029, fewer than 40% of new global LNG contracts will index to US Henry Hub (per Poten & Partners data), as buyers shift toward Brent or non-USD pricing.

Henry Hub indexing dropped from 70% to 58% (2020-24) per Poten data. Qatar and Russia push Brent linkage while China demands yuan pricing. Sub-40% threshold marks dollar's commodity pricing collapse.

The Mechanism

LNG contracts traditionally indexed to Henry Hub, the US natural gas benchmark, for pricing. This linked global gas prices to US market conditions and ensured dollar denomination.

The shift toward Brent crude linkage now serves multiple buyer interests simultaneously. European buyers prefer Brent correlation because it aligns with their broader energy mix and reduces basis risk. Asian buyers increasingly seek diversification from US market volatility, particularly following the extreme price swings of 2021-2022. Producer nations, most notably Qatar and Russia, prefer oil-linked pricing because it provides greater revenue stability and typically delivers higher realized prices. China, now the world's largest LNG importer, increasingly demands yuan pricing as a condition for long-term contracts, using its buying power to reshape market conventions.

Investment Implications

The LNG pricing shift creates distinct winners and losers in energy markets. Non-US LNG producers with pricing flexibility, particularly Qatar and Australia, stand to benefit as they can offer buyers the indexing arrangements they prefer. Trading firms capable of multi-benchmark arbitrage gain from the increased complexity, as spread relationships between Henry Hub, Brent, and JKM (Japan Korea Marker) create profit opportunities. Financial institutions building yuan-denominated energy trading infrastructure position themselves for a world where dollar dominance fades.

Conversely, US LNG exporters face structural disadvantage as buyers increasingly resist Henry Hub indexing. Dollar-centric energy trading platforms risk marginalization as alternative pricing mechanisms proliferate. Portfolios built on assumptions of continued Henry Hub dominance may find their return assumptions fundamentally challenged.

The De-Dollarization Signal

LNG pricing shifts represent broader de-dollarization in commodity markets. When major commodities price in non-USD terms, the dollar's reserve currency privilege erodes. This connects directly to the Financial Fragmentation dynamics reshaping the global monetary order.

Forecast 2: China Gallium Nitride Export Controls

75% probability: By 2026, China will impose export controls on gallium nitride (GaN) semiconductor wafers (per MOFCOM notices), further squeezing RF chip supply chains.

Beijing already banned exports of raw gallium and germanium in 2023. GaN is a strategic derivative used in military radars and 5G components. With Western reliance on imported GaN capacity, China is positioned to weaponize this material next. Given the pattern of broadening rare-material controls, a GaN export ban by 2026 is very likely.

The Strategic Logic

GaN semiconductors occupy a uniquely critical position in modern technology. Military applications rely heavily on GaN for radar systems and electronic warfare capabilities, where the material's superior power handling and efficiency provide decisive advantages over silicon alternatives. The telecommunications sector depends on GaN for 5G base stations, where power amplifiers must operate at frequencies and power levels that silicon cannot match. Electric vehicle power electronics increasingly adopt GaN for its efficiency advantages, while satellite communications systems require GaN's ability to operate reliably in extreme conditions.

China's control of 98% of gallium production creates a severe chokepoint. While some GaN wafer manufacturing exists outside China, the upstream supply chain remains overwhelmingly concentrated. Export controls on processed GaN wafers would force the same costly supply chain restructuring that the semiconductor industry is now experiencing with advanced chips.

Investment Implications

The GaN export control scenario creates a clear bifurcation in the semiconductor materials sector. Non-Chinese GaN manufacturers, particularly Wolfspeed and II-VI (now Coherent), would benefit from supply constraints that their competitors cannot navigate. Companies advancing alternative materials, especially silicon carbide, which can substitute for GaN in certain power electronics applications, gain strategic value. Defense contractors that have already secured non-Chinese supply chains find themselves with significant competitive advantage over less prepared rivals.

The losers in this scenario face difficult transitions. Telecom equipment makers dependent on Chinese GaN supply would face both cost increases and production disruptions. Electric vehicle power electronics suppliers, many of whom source from China for cost reasons, would need expensive supply chain restructuring. Semiconductor firms that have not invested in supply chain diversification would find themselves scrambling for alternatives in a seller's market.

Timeline Catalysts

The escalation path toward GaN export controls follows a predictable pattern. In 2025, further escalation of US chip controls likely triggers formal retaliation planning within China's Ministry of Commerce (MOFCOM). By 2026, MOFCOM would announce GaN export licensing requirements, not an outright ban, but a mechanism for controlling flows to specific countries. From 2027 onward, a full export ban on processed GaN wafers to designated unfriendly nations becomes increasingly probable, particularly if US-China technology tensions continue their current trajectory.

Forecast 3: Russian Oil Pricing in Non-USD Currencies

30% probability: By 2030, Russia will price at least 50% of its oil exports in Chinese yuan or other non-USD currencies, with explicit bilateral settlement agreements announced by Moscow and Beijing (per official trade disclosures).

Russia already accepts rupees/yuan for 40% of oil exports. Reaching 50% non-USD pricing requires only India/China compliance. This breaks 50-year petrodollar monopoly, with cascading effects on dollar recycling.

The Mechanism

Post-sanctions, Russia has methodically restructured its oil trade to bypass dollar-based systems. Yuan settlements with China, now Russia's largest oil buyer, have become routine, with major Russian oil companies maintaining yuan accounts at Chinese banks. India, the second-largest buyer of Russian crude, settles in rupees through a growing network of Vostro accounts at Indian banks. UAE intermediaries enable dirham settlements for Russian oil that is re-exported to third markets. For trade with friendly nations, Russia has explored ruble pricing, though this has gained less traction due to the ruble's limited international acceptance.

Reaching the 50% non-USD threshold requires only the continuation of current trends. China and India together account for over 60% of Russian oil exports, and both nations have strong incentives to reduce their dollar dependence: China for strategic reasons, India to reduce currency volatility and sanctions exposure.

Investment Implications

This de-dollarization creates new opportunities in the financial infrastructure space. Providers of yuan-based financial infrastructure, including Chinese banks and their international branches, benefit from increased transaction volumes and relationships. Gold gains importance as an alternative settlement asset, particularly for transactions where neither party fully trusts the other's currency, and central bank gold accumulation reflects this dynamic. Commodity trading firms with robust multi-currency capabilities capture business that dollar-focused competitors cannot serve.

The dollar-centric financial system faces corresponding challenges. Energy financing that assumes dollar denomination becomes less relevant as non-dollar trade grows. US sanctions enforcement becomes less effective as target countries develop alternative payment channels. Perhaps most significantly for US fiscal policy, Treasury demand from petrodollar recycling, a key source of foreign purchases of US government debt, diminishes as fewer oil dollars flow through the traditional system.

The Petrodollar Implications

The petrodollar system that emerged in the 1970s required oil exporters to price in dollars and recycle their surpluses into US Treasuries. This arrangement provided cheap financing for US deficits while ensuring global dollar demand. Russian de-dollarization breaks this loop for the world's second-largest oil exporter. The precedent matters more than the volume: if Russia can successfully trade outside the dollar system, other nations gain confidence that they can too.

Forecast 4: Brazil Agricultural Export Tax

35% probability: By 2028, Brazil will enact a 2% tax on exported agricultural commodities (like soy and sugar) to fund massive domestic fertilizer subsidies (in its official budget law).

Brazil often uses trade taxes to stabilize internal markets. In 2024, the government varied export tariffs on food to curb inflation. Extending that approach, a small export tax dedicated to subsidizing local fertilizer (a known weakness for Brazilian farmers) is plausible. This leverages Brazil's agri-export dominance for strategic ends, a mild form of mercantilism for food security.

The Strategic Logic

Brazil is the world's largest exporter of soybeans, sugar, and coffee, commanding market shares that give it genuine pricing power. However, this agricultural superpower depends heavily on imported fertilizers, creating a strategic vulnerability that became painfully apparent when the Ukraine war disrupted Russian potash and fertilizer supplies.

An agricultural export tax would achieve multiple objectives simultaneously. The revenue generated would fund fertilizer subsidies, enabling domestic production expansion that reduces import dependence on Russian and Chinese suppliers. By modestly raising export prices, the tax would help stabilize domestic food prices during periods of high global demand, a persistent political concern in Brazil. Most fundamentally, such a tax leverages Brazil's agricultural export dominance for strategic national benefit, converting commodity market power into fiscal resources and food security.

Investment Implications

The Brazil agricultural export tax scenario reshapes the competitive landscape across the agricultural value chain. Brazilian fertilizer producers would receive direct benefit through subsidies funded by the export tax, improving their competitive position against imports. Domestic agricultural input suppliers gain market share as the economics shift in favor of local sourcing. Brazilian farming operations with cost advantages, particularly those using precision agriculture or integrated supply chains, can absorb the tax more easily than marginal producers.

The challenged players in this scenario face margin compression from multiple directions. Global commodity traders would see their margins squeezed between higher Brazilian export prices and buyer resistance to paying more. Importing nations, particularly in Asia and the Middle East, face higher prices for Brazilian commodities that have few near-term substitutes. Brazilian exporters operating at the margin face competitiveness pressure, particularly against US and Argentine competitors who would not face equivalent taxation.

Forecast 5: Coordinated Agricultural Export Quotas

70% probability: By 2027, following a major climate event, at least two G20 agricultural exporters will impose coordinated export quotas on wheat/rice/corn, affecting over $50B in global food trade (announced via official trade ministry notices).

India banned wheat exports in 2022 after heatwaves. Argentina taxed grain exports at 33% in 2024. The next severe drought/flood will trigger coordinated restrictions as countries prioritize domestic food security. Precedent suggests this is highly likely when climate stress hits major producers.

The Climate Trigger

Climate volatility increasingly disrupts agricultural production, and each disruption triggers protective nationalist responses. India's 2022 wheat export ban following a devastating heatwave demonstrated how quickly the world's second-largest wheat producer can withdraw from global markets. Argentina's 2024 grain export taxes, imposed amid severe drought conditions, showed that even traditional free-trading agricultural exporters will prioritize domestic needs when supply falls short. The recurring pattern of rice export restrictions across Asian producers, from India to Thailand to Vietnam, reveals how quickly food nationalism can cascade across a region.

The pattern is unmistakable: climate events trigger food nationalism. As climate volatility increases in frequency and severity, the probability of coordinated restrictions rises correspondingly. Two G20 agricultural exporters facing simultaneous climate stress would almost certainly coordinate their responses.

Investment Implications

Food security becomes an investable theme as climate volatility increases. Domestic food producers in importing nations benefit from the protective premium that supply disruptions create: when imports become unreliable, local production commands higher prices. Agricultural technology companies, particularly those focused on climate resilience, drought tolerance, and yield optimization, become strategic investments rather than merely productivity plays. Food security infrastructure investments (storage, cold chain, alternative protein) gain strategic significance beyond their commercial returns.

The challenged sectors face structural rather than cyclical headwinds. Food-importing nations must accept higher costs and supply uncertainty as a permanent feature of agricultural markets. Global grain traders see their margin opportunity diminish as government-to-government deals replace market transactions. Processed food companies with significant commodity exposure face input cost volatility that hedging cannot fully address.

The Food Security Nexus

Food nationalism connects to broader mercantile dynamics in ways that amplify market impacts. Nations prioritizing domestic food security withdraw from global markets during stress, reducing available supply exactly when prices are already elevated. This withdrawal amplifies price volatility and triggers cascading restrictions as other nations respond to the same signals. The interconnection between food security, energy costs (for fertilizer and transport), and climate creates a vulnerability matrix that will repeatedly generate nationalist responses.

Forecast 6: Nigeria Lithium Export Duty

60% probability: By 2028, Nigeria will impose a 10% export duty on lithium concentrate (per Federal Gazette), copying Indonesia's approach.

With Africa's largest lithium discoveries, Nigeria sees an opportunity. In late 2023 it announced Chinese-backed lithium processing plants. A 10% duty on raw lithium exports would further coerce development of domestic battery-grade refining, giving local industry guaranteed value-add before exports.

The Indonesia Model

Indonesia demonstrated the resource nationalism playbook that Nigeria is now positioned to replicate. In 2020, Indonesia banned raw nickel ore exports entirely, forcing international miners to choose between investing in domestic smelting capacity or losing access to Indonesian nickel. The result was massive investment in Indonesian processing facilities, with over $30 billion committed to domestic smelters. The outcome transformed Indonesia from a raw material supplier into the dominant force in global nickel processing, capturing the value-add that previously flowed to China.

Nigeria can apply precisely this logic to lithium. The country possesses Africa's largest lithium deposits, and global demand for the metal is surging as electric vehicle production scales. By taxing or restricting raw lithium exports, Nigeria can force investment in domestic processing capacity, capturing more of the value chain and creating industrial jobs. The Chinese have already signaled their willingness to invest, and late 2023 saw announcements of Chinese-backed lithium processing plants in Nigeria.

Investment Implications

The Nigeria lithium scenario creates a distinct investment landscape across the battery supply chain. Nigerian lithium processing investments, particularly joint ventures with established battery materials companies, offer exposure to both the underlying commodity and the value-add premium that processing captures. Chinese battery companies with existing Nigerian partnerships, particularly those that moved early while terms were favorable, stand to benefit from secured supply. Domestic value-add manufacturers in Nigeria gain protected access to feedstock that international competitors cannot match.

The challenged players face difficult strategic choices. International miners who structured operations around raw material exports find their business model undermined: either invest in Nigerian processing or lose access to the resource. Lithium importers face higher costs as Nigeria captures more of the value chain domestically. Battery makers without African supply chain positioning may find themselves shut out of one of the world's most important emerging lithium provinces.

The African Resource Play

Nigeria's lithium policy signals broader African resource nationalism that investors must factor into their strategic assumptions. Other African nations with critical minerals face similar incentives to capture more value domestically. The DRC, controlling 74% of global cobalt, has already implemented export taxes and is exploring further restrictions. Zimbabwe, with significant lithium deposits, has announced processing requirements for lithium exports. South Africa, dominant in platinum group metals, faces political pressure to capture more domestic value. The pattern is clear: Africa's resource wealth will increasingly be leveraged for domestic development rather than exported in raw form.

Forecast 7: US Defense Rare Earth Restrictions

65% probability: By 2029, the US will mandate that all critical defense subsystems (as defined by DoD) contain less than 10% Chinese-origin rare earth content, forcing a $15B+ supply chain reorganization (per Federal Acquisition Regulation update).

Current US weapons systems depend on Chinese rare earths for magnets, electronics, and sensors. The F-35 contains 920 pounds of rare earth materials. New regulations would force defense contractors to trace and replace supply chains, driving up costs 30-50% but creating protected markets for allied producers.

The Strategic Logic

Defense dependency on Chinese rare earths creates an unacceptable vulnerability that military planners can no longer ignore. During any serious conflict with China, Beijing could cut off rare earth supply entirely, and modern weapons systems cannot function without these materials. The F-35 fighter jet alone contains 920 pounds of rare earth materials, from the permanent magnets in its targeting systems to the specialized alloys in its engine components. Beyond supply cutoff risk, the opacity of current supply chains enables infiltration risks that defense and intelligence officials have warned about for years. Allied nations face similar vulnerabilities, creating a shared interest in developing alternative supply chains.

The 10% threshold represents a pragmatic acknowledgment that complete elimination of Chinese content is impractical in the near term, while still forcing fundamental supply chain restructuring. Tracing rare earth content through complex supply chains will require new documentation and verification systems. Replacing Chinese content will require investment in alternative production that does not yet exist at scale. The mandate essentially forces the creation of a parallel rare earth supply chain for defense applications.

Investment Implications

The defense rare earth mandate creates a protected market that benefits specific players with secure supply chains. Non-Chinese rare earth producers, particularly MP Materials in the United States and Lynas in Australia, gain effective monopoly access to the most demanding and highest-margin customers in the market. Allied processing facilities, especially the joint ventures Japan has developed and Australia's expanding rare earth processing capacity, benefit from guaranteed defense demand. Technologies for rare earth recycling and substitution gain commercial viability as their value proposition improves against now-restricted Chinese supply.

The transition imposes significant costs on the current supply chain. Defense contractors face restructuring costs estimated at $15 billion or more across the industry, as they trace, verify, and replace Chinese-origin content. Chinese rare earth exporters lose access to their highest-margin customers, defense applications that paid premium prices for specialized materials. Defense programs face timeline delays as supply chain restructuring takes longer than optimistic projections assume, potentially stretching delivery schedules for critical weapons systems.

The Reshoring Catalyst

Defense rare earth restrictions serve as a catalyst accelerating broader critical mineral reshoring. The defense mandate creates anchor demand for non-Chinese processing capacity: guaranteed, long-term purchases that improve project economics. With defense demand securing baseline utilization, commercial applications become economically viable additions rather than speculative ventures. The defense sector essentially de-risks private investment in rare earth production, processing, and recycling, with benefits that extend far beyond military applications.

The Resource Nationalism Playbook

These forecasts reveal a consistent pattern in how resource nationalism operates:

Stage 1: Concentration Recognition

Nations recognize they control critical supply. China identified rare earths as strategic decades ago. Indonesia recognized nickel leverage. Nigeria now sees lithium opportunity.

Stage 2: Export Restriction

Raw material exports are taxed or banned to capture domestic value. This forces investment in local processing or forfeiture of supply.

Stage 3: Processing Dominance

With upstream control and processing investment, producing nations dominate global value chains. China's rare earth processing exceeds its mining share. Indonesia now leads nickel processing.

Stage 4: Strategic Leverage

Resource control translates to geopolitical leverage. Supply can be weaponized during disputes. Access becomes a diplomatic currency.

Investment Framework

Navigating resource nationalism requires explicit assessment of supply chain exposure and strategic positioning. The traditional commodity investment approach, focused primarily on supply-demand balances and cost curves, must now incorporate geopolitical analysis as a central element.

Portfolio Considerations

Mapping critical mineral exposure demands rigorous supply chain analysis. For each portfolio company, investors must understand which critical minerals flow through their supply chains, where concentration risks exist, and how dependent operations are on any single source country. This goes beyond first-tier suppliers to the raw materials that underpin component manufacturing. Substitution options vary dramatically across materials and applications: some minerals have ready alternatives, others have none. The defensibility of current supply chain positioning depends on contractual relationships, inventory policies, and the availability of alternative sources.

Evaluating producer positioning requires understanding the intersection of geology and politics. Resource producers may benefit from nationalism trends when they operate in countries imposing export restrictions, as they capture more of the value chain domestically. However, policy risks can threaten current operations when governments demand greater state participation, higher taxes, or processing mandates. The most favorably positioned producers align their interests with host government priorities, making themselves essential partners rather than extractive foreigners.

Downstream impact assessment must be frank about cost pass-through potential. Input cost increases from supply chain restructuring will compress margins for companies without pricing power. Companies with strong brands or essential products can pass costs to customers; commodity producers cannot. Restructuring investments (building alternative supply relationships, qualifying new suppliers, investing in recycling or substitution) require capital that reduces near-term returns even as it builds long-term resilience.

Sector Implications

The electric vehicle and battery sector faces critical exposure to resource nationalism. Lithium, cobalt, and nickel supply all show concentration patterns that create policy risk. The winners in this sector are companies building integrated supply chains that secure materials through direct investment in producing countries or long-term offtake agreements with aligned producers.

Defense contractors face equally critical exposure through rare earth dependency. The opportunity lies in reshoring investments that create protected domestic supply chains, though the transition costs are substantial. Companies positioned as essential partners in building alternative supply capacity will benefit from government support and guaranteed demand.

The renewables sector has high exposure, particularly for wind turbines requiring rare earth permanent magnets. Alternative technologies, including motor designs that reduce rare earth requirements, represent an opportunity for companies that can deliver equivalent performance with more secure supply chains.

Electronics face high exposure through gallium and germanium supply, both heavily concentrated in China. Diversified sourcing strategies that secure material from multiple geographies offer protection, though this typically comes with higher costs.

Agricultural exposure is more moderate, centered on fertilizer costs and export restriction risks. The opportunity lies in food security plays: companies enabling domestic production in importing countries or providing technology that reduces fertilizer requirements.

Conclusion: The Permanent Scarcity Premium

Resource nationalism is not a temporary phenomenon. It reflects structural realities that will persist for decades.

The green energy transition creates unprecedented mineral demand. Geological concentration creates leverage for producing nations. Climate volatility threatens agricultural supply chains. Each dynamic reinforces state control over critical resources.

For investors, this means commodity exposure must be evaluated through a geopolitical lens. Supply chain resilience matters more than spot price optimization. Alignment with producing nation interests matters more than pure extraction economics.

The winners in this environment are producers with strategic resources and the political positioning to capture domestic value. The losers are consumers dependent on concentrated supply chains without alternatives.

Resource nationalism is the physical manifestation of modern mercantilism. When commodities become weapons, access becomes strategy.

Series Navigation

Previous: Technology and AI Sovereignty

This analysis is part of our seven-part Modern Mercantilism research series: