Introduction: The Labor Cost Crisis Meets the Technology Solution

Three months ago, I walked into a boutique hotel in Manhattan's Lower East Side. No front desk. No lobby attendant. No bellhop studying me as I fumbled with luggage. I opened the app on my phone, tapped the screen, watched the door unlock remotely, and stepped into a spotless room with the temperature pre-set to exactly 68 degrees.

The entire interaction took 90 seconds. The hotel operator's labor cost for my check-in? Zero dollars. For a three-night stay generating $900 in revenue, the property avoided approximately $135-180 in direct labor costs that a traditional hotel would have incurred.

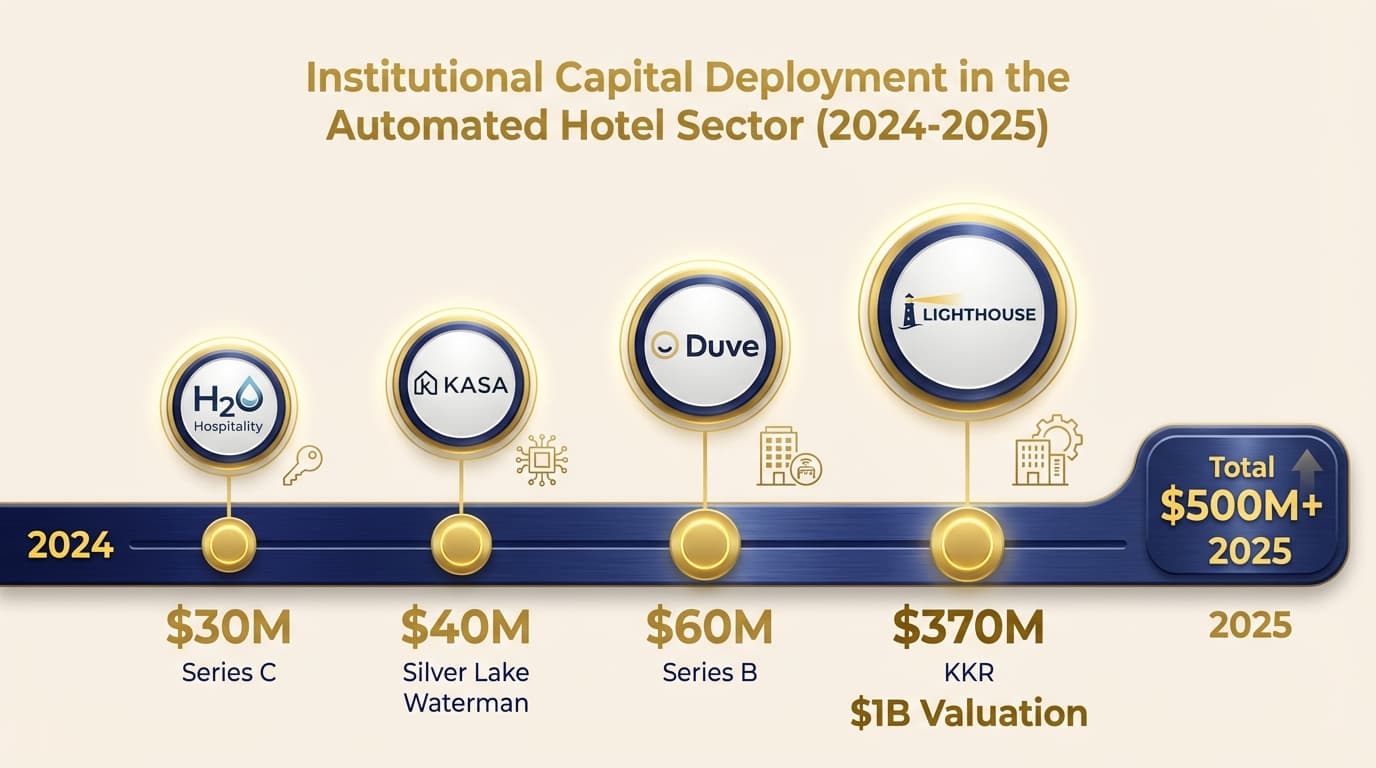

That property was operated by Kasa, which just raised $40 million from Silver Lake Waterman to scale this exact model. A week later, KKR led a $370 million round into Lighthouse at a $1 billion valuation, betting on AI-powered hotel operations. These are not venture experiments. This is institutional capital recognizing that hospitality economics are being fundamentally rewritten.

I've watched too many investors dismiss automated hotels (sometimes called "dark hotels" in industry parlance, referring to properties operating with minimal visible staff) as a niche hospitality trend or a pandemic-era curiosity that would fade when labor markets normalized. They're missing the point entirely. This is not about temporary staffing challenges. This is about permanent unit economics transformation in a $600+ billion global hotel industry where labor costs have been structurally incompressible for decades.

The operators who understand this are building businesses that look less like Marriott and more like data centers with beds.

Key Takeaways

- Labor cost reduction: 50-60% decrease vs. traditional hotels (35-45% to 15-20% of revenue)

- Capital deployed: $500M+ institutional investment in automated hotel tech in 2024-2025

- Market size: Unmanned hotel market projected at $6.66 billion by 2032

- Target returns: 18-22% net IRR for tech-first hotel assets vs. 12-15% traditional

- RevPAR lift: 8-12% improvement through AI dynamic pricing vs. human revenue management

- Operating leverage: 24/7 operations with no night shift premiums or weekend multipliers

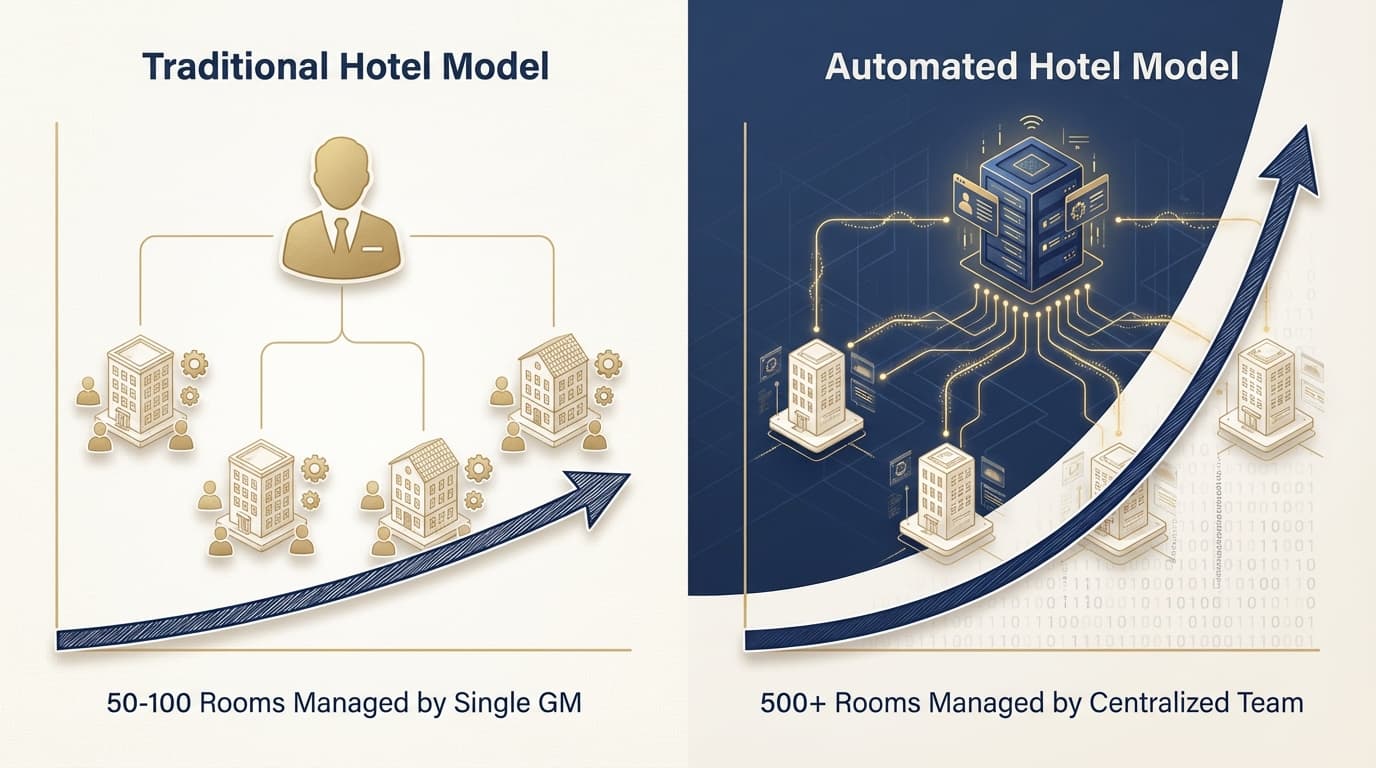

- Scalability advantage: Single operations team can manage 500+ rooms vs. 50-100 in traditional model

Why Traditional Hotel Economics Are Broken

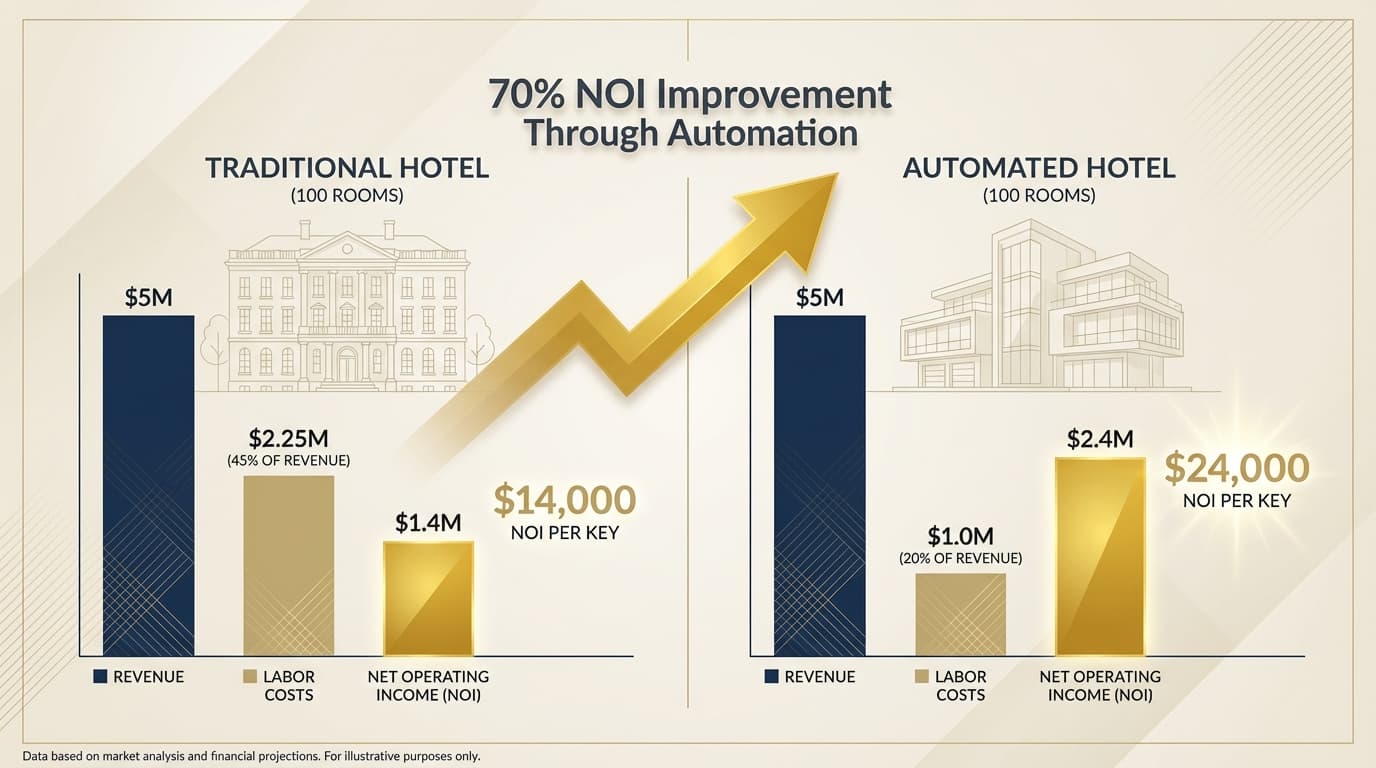

Let me start with a number that should terrify every traditional hotel operator: 35-45% of revenue goes to labor. For a 100-room hotel generating $5 million in annual revenue, that's $1.75-2.25 million consumed by payroll before a single dollar reaches bottom line profitability.

The 2025 Hotel Labor Costs Report from HotelData.com reveals the structural challenge. Even as hotels tightened operations through 2024-2025, cutting hours per occupied room by 3.2%, labor as a percentage of revenue remained stubbornly elevated. Properties managed to protect margins not by solving the labor cost problem, but by squeezing more productivity from fewer workers. This is optimization at the margin, not transformation.

Traditional Hotel Labor Cost Breakdown (Percentage of Revenue):

- Front desk and reservations: 8-12%

- Housekeeping: 12-16%

- Food and beverage: 7-10%

- Maintenance: 4-6%

- Management and administration: 4-7%

- Total: 35-45%

Every hotel in America faces the same math. You can negotiate with linen suppliers, switch PMS systems, renegotiate franchise fees, but labor remains the largest controllable expense and the least compressible. Minimum wage increases, benefits inflation, turnover costs, overtime premiums, scheduling complexity continue to push costs upward.

Traditional hotels have tried everything: cross-training, labor scheduling software, outsourcing housekeeping, reducing amenities. These are incremental gains. The unit economics remain fundamentally constrained.

The Three Structural Problems with Traditional Hotel Labor:

1. Fixed costs with variable demand. You need front desk coverage 24/7 whether you have 20% or 100% occupancy. Night auditors, weekend shift differentials, holiday premiums are all fixed overhead divorced from actual demand.

2. Non-scalable operations. A front desk agent can check in perhaps 8-10 guests per hour under optimal conditions. To handle peak check-in volume, you need multiple agents. But those agents sit idle during off-peak hours, yet you're still paying them.

3. High turnover destroying knowledge capture. U.S. hotel turnover rates run 60-80% annually. Every departing employee takes operational knowledge with them. Training costs for replacement workers run $3,000-5,000 per position. This knowledge loss is a permanent drag on efficiency.

These are not problems technology can optimize. They require elimination.

The Automated Hotel Model: Unit Economics That Actually Work

Now let's examine what happens when you rebuild hotel operations from first principles, assuming technology handles every task that doesn't require human judgment or emotional intelligence.

Kasa operates over 100 properties across North America with this exact thesis. Their recently announced $40 million growth round from Silver Lake Waterman is designed to accelerate their proprietary hospitality operating system. This is not a property management system. This is a full-stack replacement of hotel operations with software and automation.

Kasa's Model:

- Check-in: Fully app-based, mobile key access, zero front desk

- Guest communication: AI-powered messaging handling 80%+ of routine inquiries

- Pricing: Dynamic revenue management algorithms adjusting rates in real-time

- Housekeeping: Scheduled via algorithms, tracked with IoT sensors, optimized by occupancy patterns

- Maintenance: Predictive using IoT data (HVAC performance, energy usage anomalies)

- Operations team: Centralized across portfolio, managing 500+ rooms from single location

The result? Labor costs drop from 35-45% of revenue to approximately 15-20%. For that same 100-room hotel generating $5 million annually, labor costs fall to $750,000-1,000,000. That's $1-1.5 million in additional operating profit annually. On a $15-20 million acquisition, that margin expansion is transformational.

Automated Hotel Labor Cost Structure (Percentage of Revenue):

- Front desk: 0% (fully automated)

- Housekeeping: 8-12% (optimized scheduling, reduced frequency options)

- Central operations team: 4-6% (manages multiple properties remotely)

- Maintenance: 2-4% (predictive vs. reactive, reduced emergency calls)

- Technology infrastructure: 2-3% (software, IoT, AI, connectivity)

- Total: 16-25%

But the labor arbitrage is only part of the story. Automated hotels (or "dark hotels" as they're sometimes called in Asia and Europe) achieve operational advantages impossible in traditional models.

The Hidden Advantages: Why This Is Not Just About Cutting Staff

Most analysts stop at labor cost reduction. That's the obvious piece. What institutional investors are actually buying is a different operating model with compounding advantages.

1. True 24/7 Operations With Zero Premium Costs

Traditional hotels pay 10-30% shift differentials for night and weekend coverage. Night auditors earn $15-22/hour in most U.S. markets, working alone with minimal supervision, handling check-ins, managing emergencies, processing accounting, monitoring security. It's one of the most expensive labor slots per hour of actual productivity.

Automated hotels operate identically at 3 PM and 3 AM. An app-based check-in at midnight costs exactly the same as noon. There are no shift premiums. No overtime. No holiday multipliers. No staffing challenges when someone calls in sick for the graveyard shift.

I've seen the data from Yanolja, the South Korean hospitality technology giant valued at over $2 billion. Their properties handle check-ins 24/7 with zero incremental labor cost per transaction. The marginal cost of the 1,000th check-in is effectively the same as the first.

2. Operational Leverage That Scales Geometrically

A traditional hotel general manager oversees perhaps 50-100 rooms effectively. Beyond that, you need multiple properties with separate management teams, separate back-office functions, duplicated overhead.

Kasa's centralized operations team manages 100+ properties simultaneously. A single customer service representative can handle inquiries from guests across 20+ properties because the AI handles tier-one questions and only escalates issues requiring judgment.

This is software economics applied to hospitality. The incremental cost of managing property 101 is far lower than managing property one. Traditional hotels face linear cost scaling. Automated hotels face logarithmic cost scaling.

3. Dynamic Pricing That Actually Works

Revenue management systems have existed for decades. But they require human revenue managers to input assumptions, override recommendations, make judgment calls. Most hotels under 150 rooms don't have dedicated revenue managers. They rely on general managers or front desk staff making pricing decisions based on intuition.

Automated hotels run pure algorithmic pricing with zero human intervention. Lighthouse, which just raised $370 million at a $1 billion valuation from KKR, provides exactly this capability. Their AI analyzes: local events, competitive set pricing, booking pace, historical patterns, weather forecasts, flight data to adjust rates every hour.

The result? RevPAR (revenue per available room) improvements of 8-12% compared to human-managed pricing. On a 100-room property averaging 70% occupancy at $180 ADR, that's an additional $165,000-250,000 in annual revenue with zero incremental cost.

4. Capital Efficiency in Development and Acquisition

Perhaps the most underappreciated advantage: automated hotels require less square footage and lower construction costs per key.

Traditional hotels need: large front desk areas, back-office space, staff break rooms, management offices, extensive F&B space if offering breakfast. A typical select-service hotel might allocate 15-20% of total square footage to operational and back-of-house space.

Automated hotels eliminate most of this. Kasa properties often operate in converted apartment buildings or boutique structures with minimal common area. You're paying for and operating only the revenue-generating space.

For new development, this translates to $10,000-15,000 lower cost per key. On a 100-key project, that's $1-1.5 million in construction savings, or 5-7% lower total development cost. On acquisition, you can underwrite higher per-key values because the operational efficiency creates more cash flow from the same physical asset.

The Institutional Capital Flood: Who Is Betting Big and Why

Venture capital loves technology narratives. What's significant about automated hotels is that growth equity and institutional investors are now deploying capital. These are investors who demand clear paths to profitability, proven unit economics, and scalable operations. They don't fund science experiments.

Major Capital Deployments (2024-2025):

Kasa raised $40 Million from Silver Lake Waterman: Silver Lake is one of the world's premier technology growth investors. They don't write $40 million checks into hospitality unless they see software-grade unit economics. Their thesis is clear: Kasa's operating system transforms hotels from labor-intensive assets into tech-enabled infrastructure.

Lighthouse raised $370 Million at $1 Billion Valuation from KKR: KKR is not a hospitality investor. They're an infrastructure and technology investor. Lighthouse provides the commercial intelligence layer that automated hotels run on, AI-powered pricing, demand forecasting, competitive analytics for 70,000+ properties globally. KKR is betting that hotels increasingly operate like data-driven infrastructure businesses, not traditional service operations.

Duve raised $60 Million Series B: Guest management platforms are the operational nervous system of automated hotels, handling pre-arrival communication, digital check-in, upselling, post-stay engagement. Duve's recent $60 million raise reflects investor recognition that guest experience software replaces front desk labor permanently.

H2O Hospitality raised $30 Million Series C: Digital transformation platforms that enable hotels to transition from traditional operations to automated models. The capital is flowing not just to pure-play automated operators, but to the infrastructure enabling traditional hotels to transform.

This is $500+ million deployed in 18 months into a sector most investors ignored five years ago. The common thread? Every investor is underwriting the same thesis: hotel labor costs are structurally compressible through technology, and the operators who execute this transformation will capture enormous value.

Conclusion: The Reinvention of Hospitality Economics

Twenty years from now, we will look back at 2024-2025 as the inflection point when hospitality stopped being a labor-intensive service business and became a technology-enabled infrastructure asset class.

The winners will not be the operators with the most properties or the biggest brands. The winners will be those who fundamentally rethought hotel operations from first principles, built proprietary technology that creates durable competitive advantages, and executed with operational discipline while competitors clung to legacy models.

I believe we're in the second inning of a multi-decade transformation. The institutional capital flowing into this space (KKR, Silver Lake, family offices) recognizes something that most hospitality investors have missed: the unit economics of hotels are being permanently restructured by technology, and the operators who execute this transformation will generate returns that look more like infrastructure than traditional real estate.

For investors willing to do the work, to understand both hospitality operations and technology systems, to separate signal from hype, and to underwrite investments based on unit economics rather than growth narratives, the opportunity is significant.

This is not about robots and gimmicks. This is about businesses that generate 18-22% IRRs with operating leverage that compounds over time. That's worth paying attention to.

For those interested in exploring other structural shifts in global capital markets, our analysis of family office allocation strategies examines how ultra-high-net-worth investors are repositioning portfolios for the next decade. We also explore emerging opportunities in West African commercial real estate, where demographic tailwinds and supply shortages are creating compelling risk-adjusted returns for patient capital.